In AVIXA’s May Pro AV Business Index, survey respondents reported gradual but noteworthy signs of recovery for the pro AV industry. They highlighted the easing of COVID-19 restrictions contributing to the stabilization of conditions. Respondents did emphasize continuing barriers to a return to status quo, including increased time and money spent on sanitization measures.

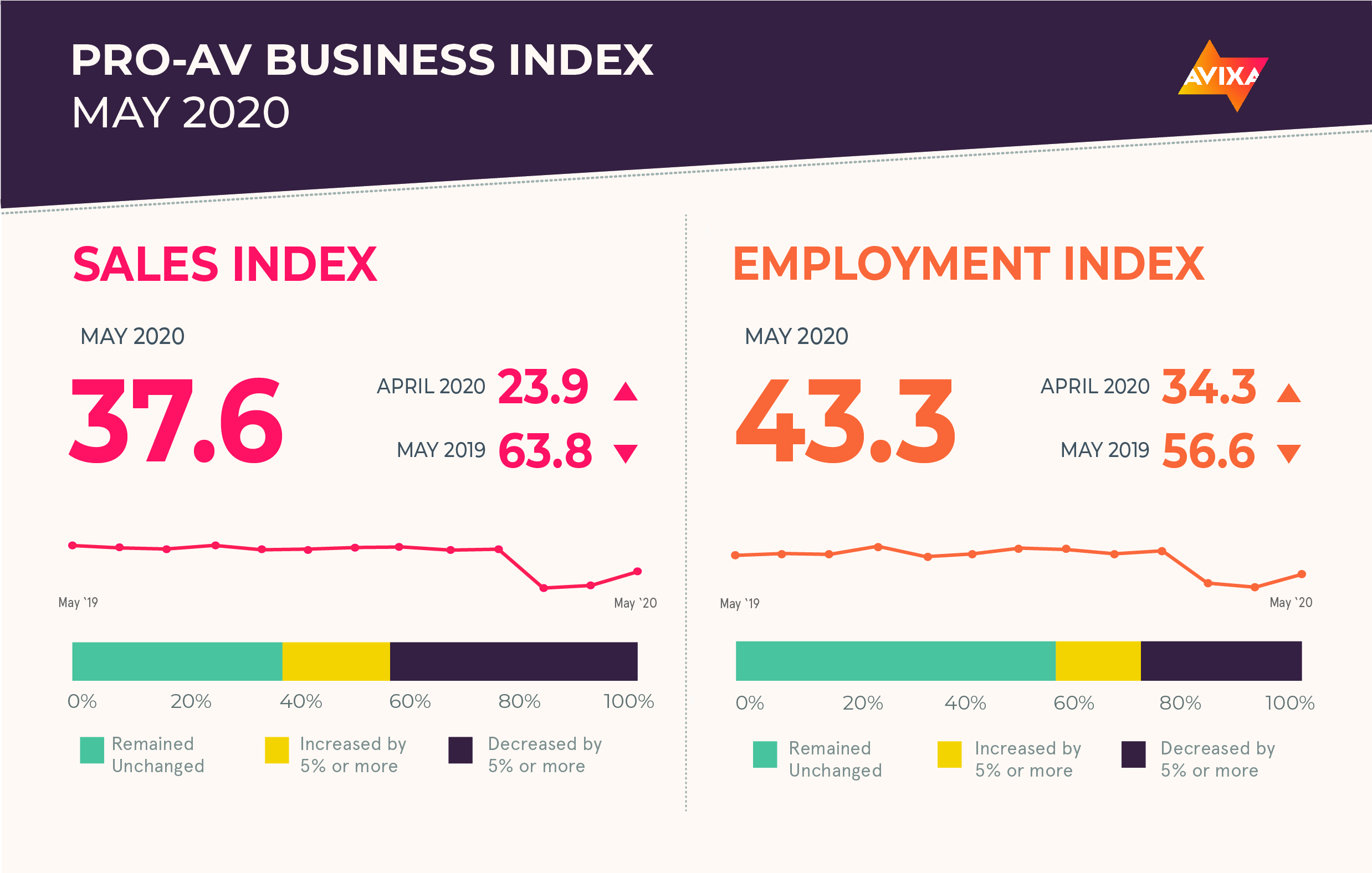

Contraction in pro AV sales continued through the month of May, with the AV Sales Index (AVI-S) clocking in at 37.6, well below the no-net-growth line of 50. On the bright side, this statistic was substantially better than the past two months, when the AVI-S was 21.3 and 23.9, respectively. With luck, the upward trend will continue, and the industry will reach neutral or perhaps even growth conditions by June.

“COVID-19 has hurt our live events team the most. Thankfully, we have been able to adapt and work with clients to support virtual meetings. Integration has been mostly unaffected, with only some projects being put on hold but not cancelled,” shared an AV integrator in North America.

The majority of survey respondents expect their revenues to regain pre-COVID-19 levels in the fourth quarter of this year. The range of responses was wide, though, with a handful of respondents expecting the recovery to take until at least 2023. Averaging all the responses together, the expectation is for the recovery to take place in the middle of the second quarter of 2021.

“As restrictions ease, pro AV companies should be thinking creatively about how they can be a part of the solution for safely operating businesses,” said Peter Hansen, economic analyst, AVIXA. “COVID-19 remains a threat, and consumers are going to act accordingly. Consider how you can deploy technology to maximize safety, such as by monitoring occupancy in restaurants and retail establishments. AV can also communicate safety measures to consumers and help reassure them that they can enter an establishment without too much risk or worry.”

U.S. unemployment numbers defied expectations and dropped in May. The official unemployment rate decreased from 14.7 percent to 13.3 percent as the economy added 2.5 million jobs. While lower than expected, economists point to lack of uniformity in response as a reason the figures may not reflect the total picture.

The AV employment index (AVI-E) increased from 34.3 to 43.3, a substantial increase. Unfortunately, that remains below the neutral growth mark of 50, meaning payrolls in AV likely continued to contract.

AVIXA is here to support the pro AV industry now and always. For AVIXA’s latest information on COVID-19’s impact on the pro AV industry and helpful resources, visit avixa.org/COVID19.

The Pro-AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report actually comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.