Growth at any level is good news to hear during the COVID-19 pandemic. However, AVIXA’s Pro AV Business Index shows that August sales barely qualify as growth.

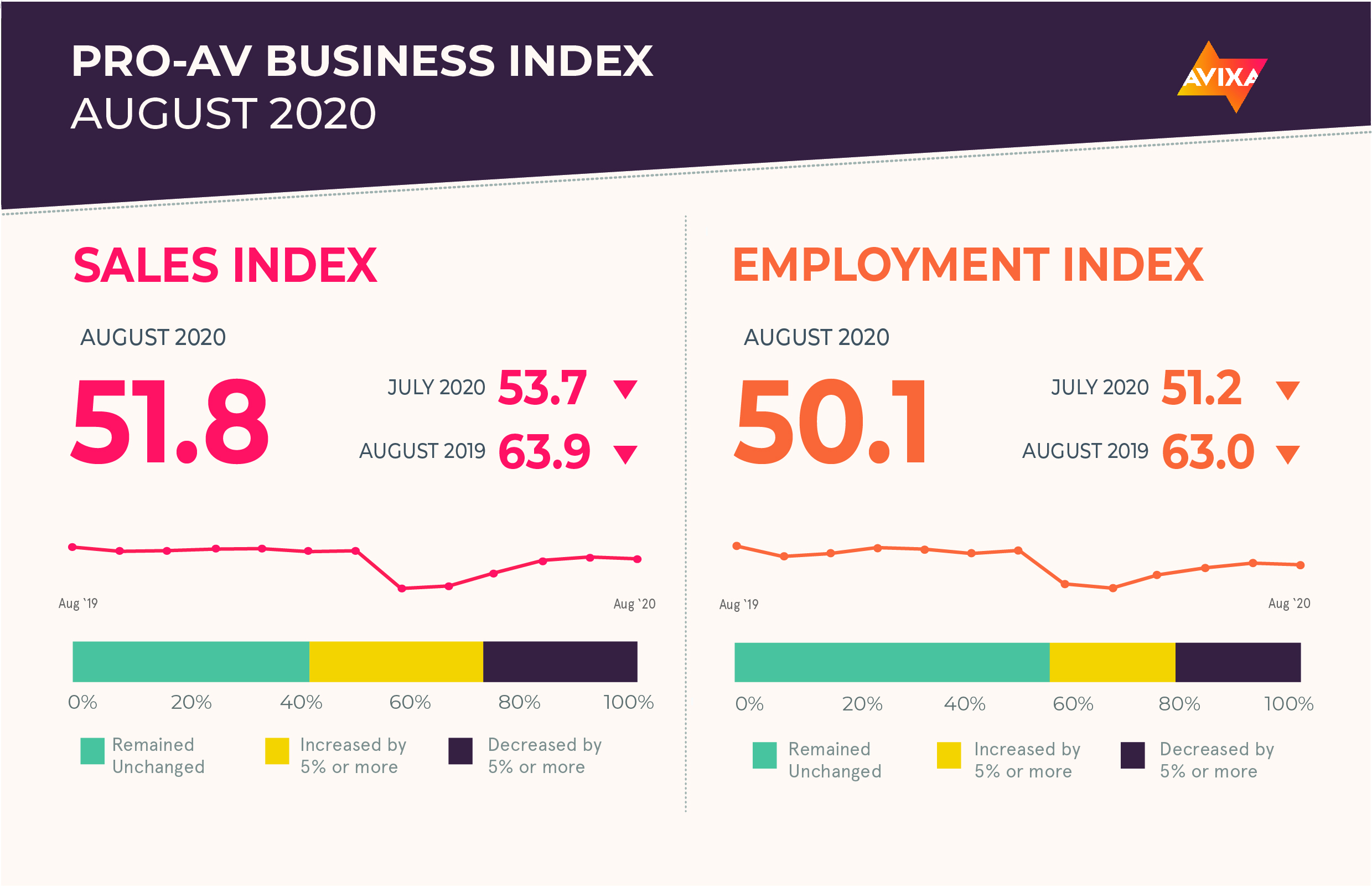

At 51.8, August’s AV Sales Index (AVI-S) is only two points above the no-net-growth level of 50 and two points below the pace recorded in July. While it’s not shocking that AV provider sales would show frailty given the overall economic environment, the AVI-S had improved in four straight months leading up to August, making the weaker observation unexpected.

“An unanticipated result like this makes us anxious for the next month’s number. Is this slight deceleration a blip or a trend?” said Peter Hansen, economic analyst, AVIXA. “Given the generally increasing strength of most macroeconomic indicators and the positive trends in our other measures of the AV industry, we continue to expect growth to strengthen as we close out the year.”

Survey respondents reveal that as the world adjusts to living with COVID-19, the net impact on pro AV is complicated. Offices, houses of worship, and schools are now largely remote, reducing in-person investment. And yet, AV is the solution to remote needs, which actually boosts spending. Unfortunately, money is tight, and many institutions are preferring cheaper DIY, consumer options to professional-grade ones. The result is an unsteady mix of growth and contraction across markets and solutions, changing from month to month.

“Lots of interest in streaming systems for schools and houses of worship, but the professional and semi-pro offerings that we would provide are too expensive for most clients. Many people are opting for iPads, Mevo cameras, and other DIY solutions,” shared an integrator in North America.

The current job market faces a pair of powerful trends, one strongly positive and the other strongly negative. On one hand, the economy is reopening and bringing jobs back along with it, while on the other, the damage absorbed during the past six months is causing major job losses. The positive side appeared in the August U.S. employment report, which revealed that the economy added 1.4 million jobs as unemployment fell from 10.2 percent to 8.4 percent. The negative side was illustrated by the unemployment insurance numbers, which showed that an average of about 1 million people filed initial claims for unemployment benefits each week of August—every single week of which was beyond the pre-pandemic record.

How do these contrasting negative and positive signals net out for pro AV employment? With no net growth. The AV Employment Index (AVI-E) for August was 50.1, signaling that payrolls neither expanded nor contracted in August. This was a similar result to July, when the AVI-E measured 51.2.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report actually comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.