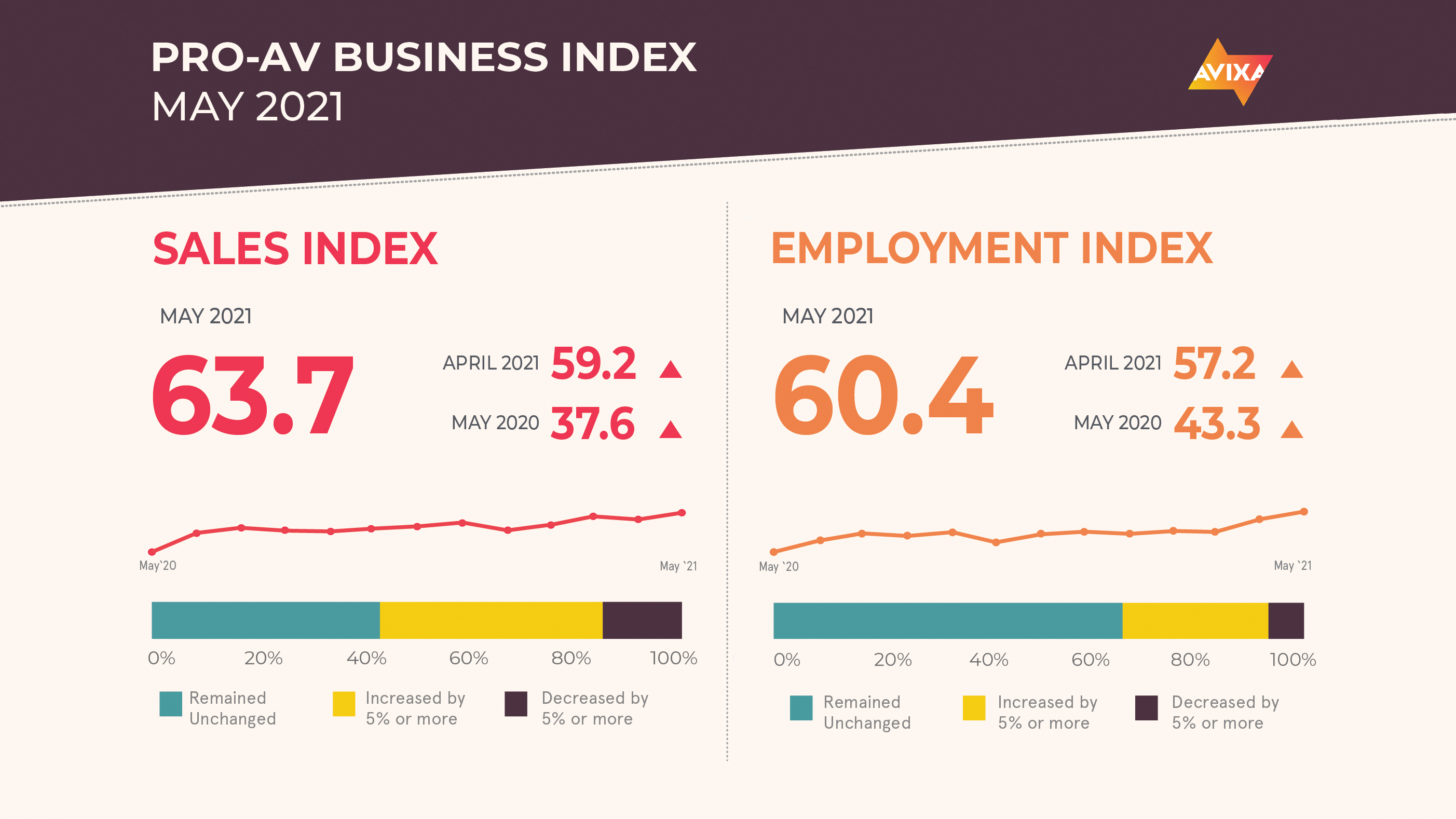

AV sales growth accelerated to new pandemic-era highs in AVIXA’s latest Pro AV Business Index. In May, the AV sales index (AVI-S) reached 63.7. This is up 4.5 points from the already strong 59.2 mark observed in April. In fact, it’s the highest level since August 2019. Improvements in the pandemic situation are the primary driving force behind the AV spending surge, with greater international proliferation of vaccines combining with major declines in global case counts to add significant fuel to the economic engine.

This story is not simply about the virus, but about how the virus affects business and consumer sentiment. The good news about the pandemic creates rising confidence, which fuels investments in construction, renovation, and tech upgrades. While positive overall, comments from survey respondents this month continued to show a mix of conditions. For example, some live events providers were optimistic about in-person events approaching full capacity, while others found themselves continuing to operate solely on virtual events. The positive spin here is that continued limitations in consumer activity due to the pandemic mean that there are still a few brakes on growth that will release in the coming months.

“Between good news on COVID-19, our research to create our new Industry Outlook and Trends Analysis, and latest sales numbers, we believe we’re headed for record highs in the AVI-S,” said Peter Hansen, economic analyst, AVIXA. “Timing-wise, a score of 70 seems reasonable by the fall, but there are good arguments as to why it could be later. It’s no guarantee, but as the world returns to normal activity, the ceiling for pro AV spending rises.”

Supply chain issues have been a growing area of challenge in the economy in general and the AV world in particular. There are two main causes for current supply chain issues: unpredictability and growth. Unpredictability has factored in as companies have underestimated demand for certain products such as cars (and therefore microchips) or for lumber. Add in the rapid growth seen in recent months and you have a situation where supplies of many key products are below ideal levels. AVIXA analysts are planning a deep dive into how this issue is impacting AV, but one finding we can highlight now is that most AV buyers report prices 5 to 10 percent higher now than before the pandemic.

In May, the AV employment index (AVI-E) saw a major acceleration for the second month in a row, leading the index to top 60 (60.4 specifically) for the first time since 2019. While the AVI-E has been above the no-net-growth level of 50 for 9 months since the onset of the pandemic, May’s figure marks just the second month since the pandemic began that AV payrolls have expanded substantially. This is a heartening result for the AV community since it means that 1) businesses are doing well enough to start significant hiring binges, and 2) AV professionals who have been unemployed or underemployed are facing better career prospects. The strong AV growth was matched in the wider economy, with the U.S. employment numbers showing 559,000 jobs added and unemployment dipping from 6.1 percent to 5.8 percent.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.