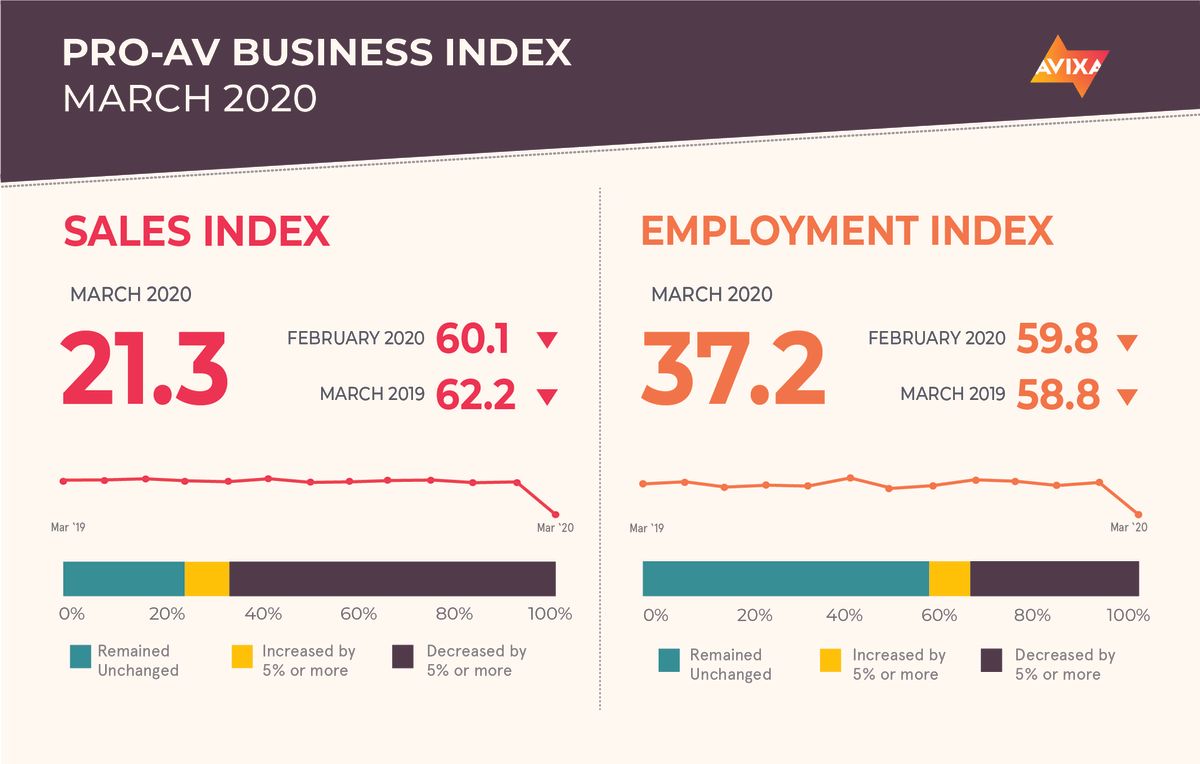

Pro AV sales have contracted for the first time since the AVIXA’s Pro AV Business Index was established in September 2016. As COVID-19 has forced billions of people into physical isolation, demand for anything outside of absolute necessities has ground almost to a halt. The result for pro AV is a massive slowdown in sales, with the AV Sales Index dropping from 60.1 in February to 21.3 in March (the no-growth level is 50).

“The reading of 21.3 is the farthest reading from the no-net-growth mark of 50 that we’ve ever recorded,” said Peter Hansen, economic analyst, AVIXA. “Our data is telling us that live events is especially hard hit, with the hospitality and transportation verticals suffering greatly as well. In verticals like education, the impact has been more mixed, with integrators and internal technicians pivoting from previous projects to facilitating a rapid transition to complete online learning.”

[Resources for AV Pros During COVID-19]

However, optimism may be warranted for two reasons. First, there remains a chance that the crisis, as deep and severe as it is, will be short. If recovery can lift off within about two quarters from the start of the crisis this March, it has a good chance of being fast enough and big enough to pull most businesses and people through. Second, governments have gotten serious about financial support to help businesses and people bridge the gap from crash to recovery. As an example, the United States passed the CARES Act, which will inject $2.2 trillion into the economy. For more on how that can assist you and your business, visit the COVID-19 impact page on AVIXA’s website at avixa.org/COVID19.

Employment data tends to reflect changes more slowly, less dramatically, and later. That trend has continued with the start of contraction, as the AV Employment Index is showing a more modest decline, with a score of 37.2. As a reminder, employment numbers tend to be a lagging indicator, as businesses often hesitate to hire workers in the face of demand and lay workers off in the face of revenue reductions. Unfortunately, this means we expect the AV Employment Index to stay low longer term, even after the AV Sales Index starts to tick back up.

Because of the lagging nature of employment and because of the timing of the survey that underpins it, this month’s U.S. Bureau of Labor unemployment report does not capture the current conditions well enough to be covered here. A metric that does show the employment impact of the crisis is the totals of people making initial applications for unemployment benefits. Leading up to the crisis, initial claims were in the low 200,000s in the United States. In the last week of March, the number spiked to 3.3 million. The next week, it hit 6.6 million. For perspective, the previous record high was about 700,000 in October 1982.

The Pro-AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report actually comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.