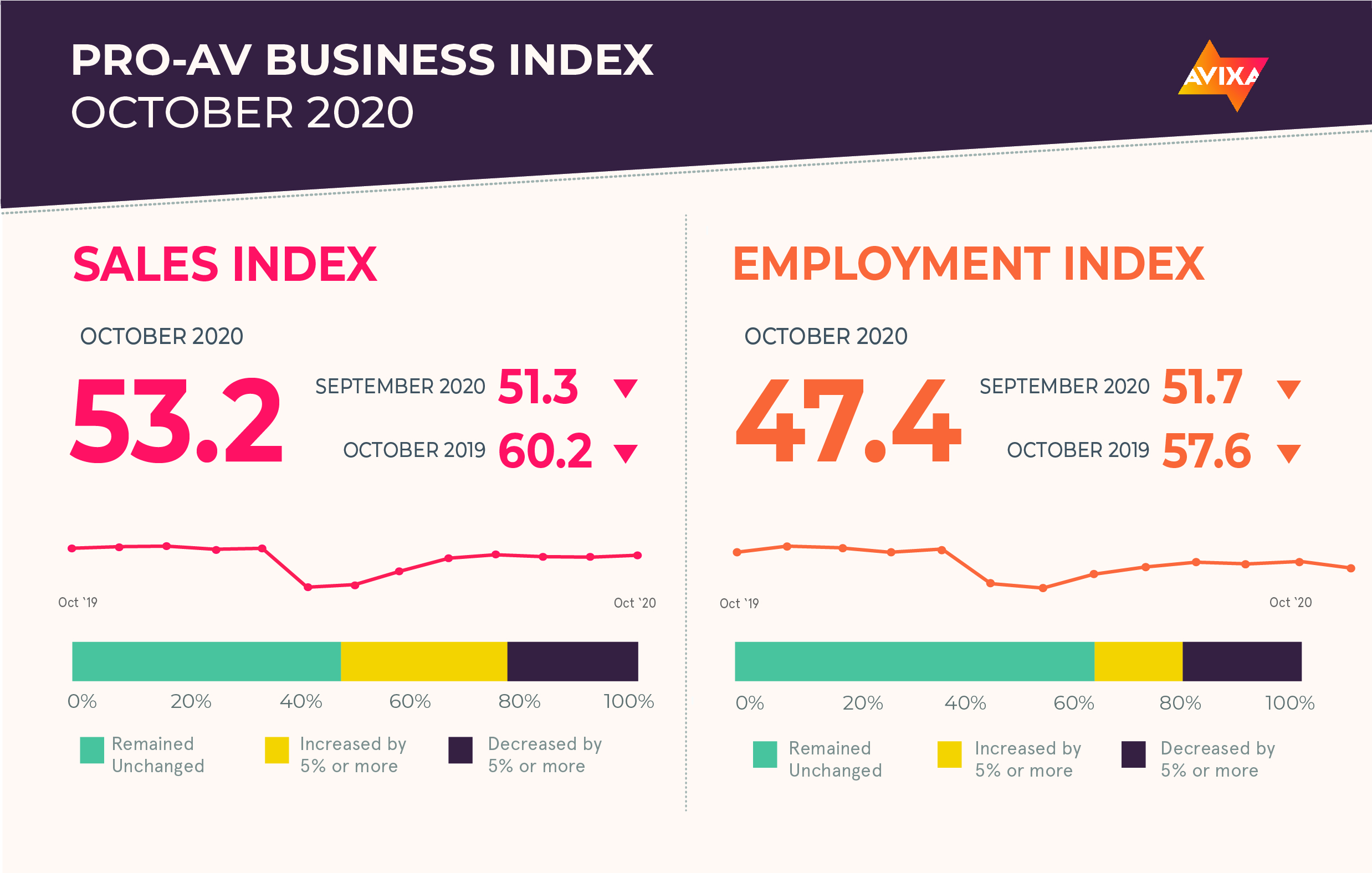

Against a complicated backdrop of GDP recovery and additional waves of coronavirus, AVIXA’s Pro AV Business Index shows that global AV sales growth accelerated in October. The AV Sales Index (AVI-S) shows that expansion remained slow, with an increase of 1.9 points, from 51.3 to 53.2.

Survey respondents identified a variety of reasons for business change. In the United States, many commenters pointed to election uncertainty, given the survey was conducted Oct. 28–Nov. 3. COVID-19 is naturally a major factor, with many survey respondents reporting difficulties due to rising numbers of cases, though improving conditions in places such as Australia are helping other businesses.

[The Integration Guide to AV in a Post-COVID-19 World]

“Let’s mention some excellent news: two vaccines have released phase three data indicating strong effectiveness. The end of COVID-19 is coming,” said Peter Hansen, economic analyst, AVIXA. “Given that normal life is now a foreseeable reality even in high-caseload areas, AV businesses should start setting themselves up for long-term success. For live events companies who have been on pause since March, a return to in-person events now beckons. For businesses who survived by making major pivots, start planning on how to restore your shelved capabilities. When vaccines proliferate enough to restore normal life, fortune will favor the prepared AV businesses.”

The U.S. and the EU released their respective preliminary third quarter GDP numbers in October, both of which showed historic growth—though not enough to offset the even more historic contraction. The EU and the U.S. are now both within a percent or two of their 2020 Q1 GDP levels, but these levels were already down several percent from levels at the end of 2019. Both regions remain on track for final GDP recovery in 2022 (though the EU is more uncertain for now). This aligns with pro AV, which is also on track to recover its 2019 revenue levels in 2022.

China also released its third quarter GDP numbers in October, though the story there could hardly be more different from the U.S. and EU. A strong (though slightly below expectations) third quarter means China’s GDP is actually up 0.7 percent from the start of the year. These positive macroeconomic numbers give strength to AVIXA’s Industry Outlook and Trends Analysis projection of a 2021 recovery for pro AV revenue in China.

The pro AV employment numbers show a more mixed bag. In October, the AV Employment Index (AVI-E) showed a small amount of contraction, measuring 2.6 points below the no-net change mark of 50. Looking at the profile of individual responses that comprise the single AVI-E number, the percent reporting no change ticked up again, reaching a level just shy of the payroll stability observed in February. Thus, while the index suggests some contraction, observers should understand that payroll volatility is declining, and staffing levels are stabilizing. For the wider economy, the October U.S. jobs report offered a pair of positive indicators: unemployment declined 1 percentage point to 6.9 percent and labor force participation increased 0.3 percent to reach 61.7 percent.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.