After slower growth in pro AV sales and employment in September, October’s numbers recuperated in AVIXA’s Pro-AV Business Index. While some survey respondents reported strong growth or clear contraction, the general sentiment centered on growth flattening for the time being.

“Business levels have seemingly plateaued—but not dropped. Possible reasons: local, national, and global economy concerns, U.S. political uncertainty, instability, and partisan battling,” shared an independent pro AV representative in North America.

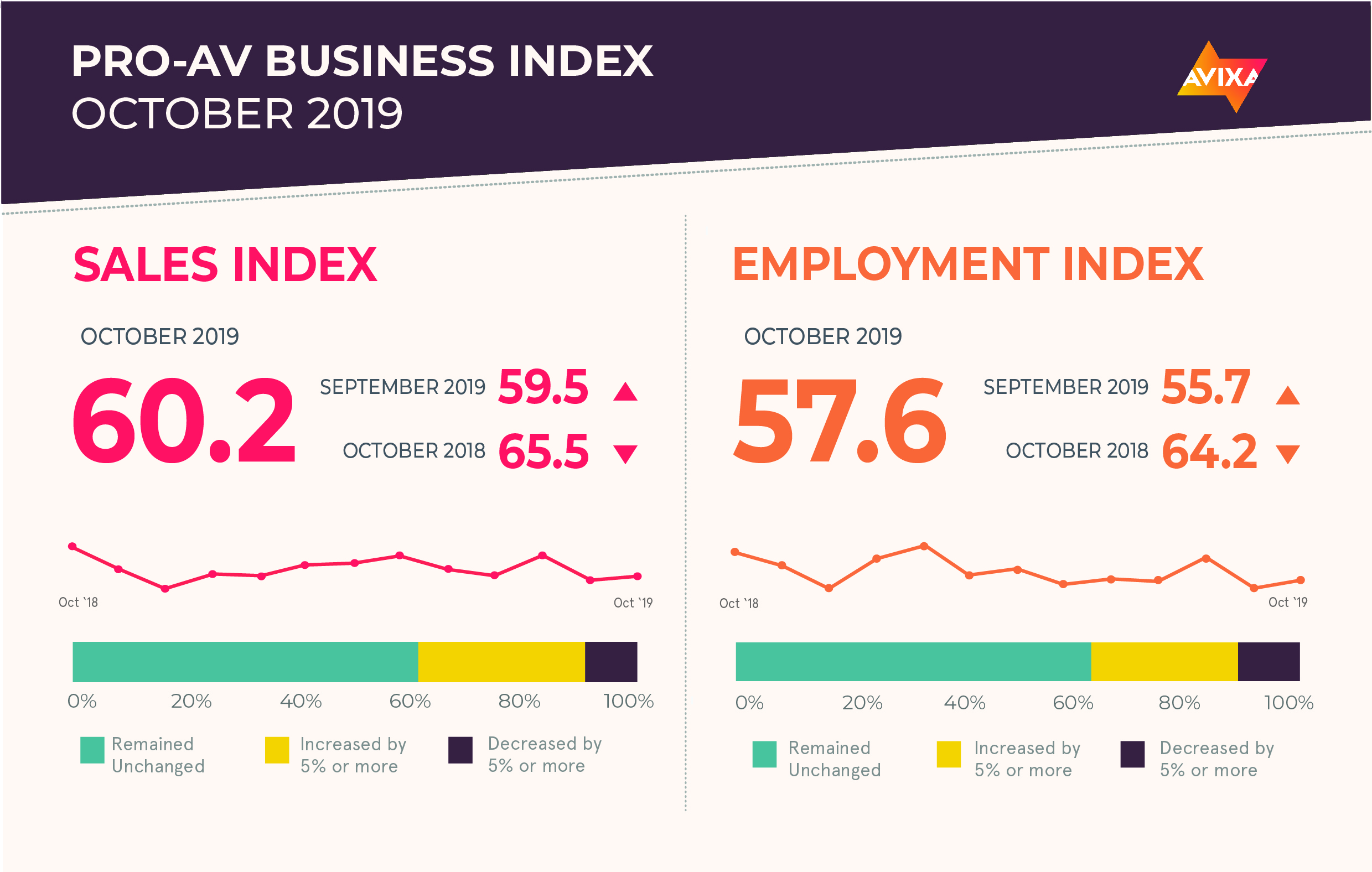

The AV Sales Index registered 60.2 for October, up from 59.5 in September.

“This is a better result than it seems at first glance, as it confirms that the drop in growth rate from August to September was not the start of a trend,” said Peter Hansen, economic analyst, AVIXA. “The October numbers are down from this time last year, when the index was in the mid-60s, which reflects that the 2019 macroeconomy is just not on the same level as 2018.”

October was unequivocally a good month for trade. The U.S. government announced a partial trade deal with China and stated that a complete deal would be finalized in stages. This was later supported when the Chinese government announced that it had agreed to roll back tariffs in stages. President Trump later contradicted the Chinese story, stating that he had not yet agreed to roll back U.S. tariffs, so uncertainty remains. In Europe, the EU and Great Britain agreed to postpone the Brexit deadline until the end of January 2020, which allows time for an election in Great Britain. This is only a continuation of the saga, of course, but it beats the no-deal exit scenario that Prime Minister Boris Johnson had threatened. This is good news for the pro AV industry, as these two trade conflicts are the biggest uncertainty factors postponing AV investments.

The October jobs report was strongly positive, though in an unusual way. The headline number was 128,000 jobs added, which is below the average of 206,000 jobs added each month between January 2011 and January 2019. But 128,000 was substantially above the prediction of 75,000. Even more positively, the report was accompanied by substantial revisions of the August and September numbers, with August being revised from 168,000 to 219,000 and September from 136,000 to 180,000. Pro AV employment saw healthy growth in October with an AV Employment Index reading of 57.6, up from September’s 55.7.

The Pro-AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report actually comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.