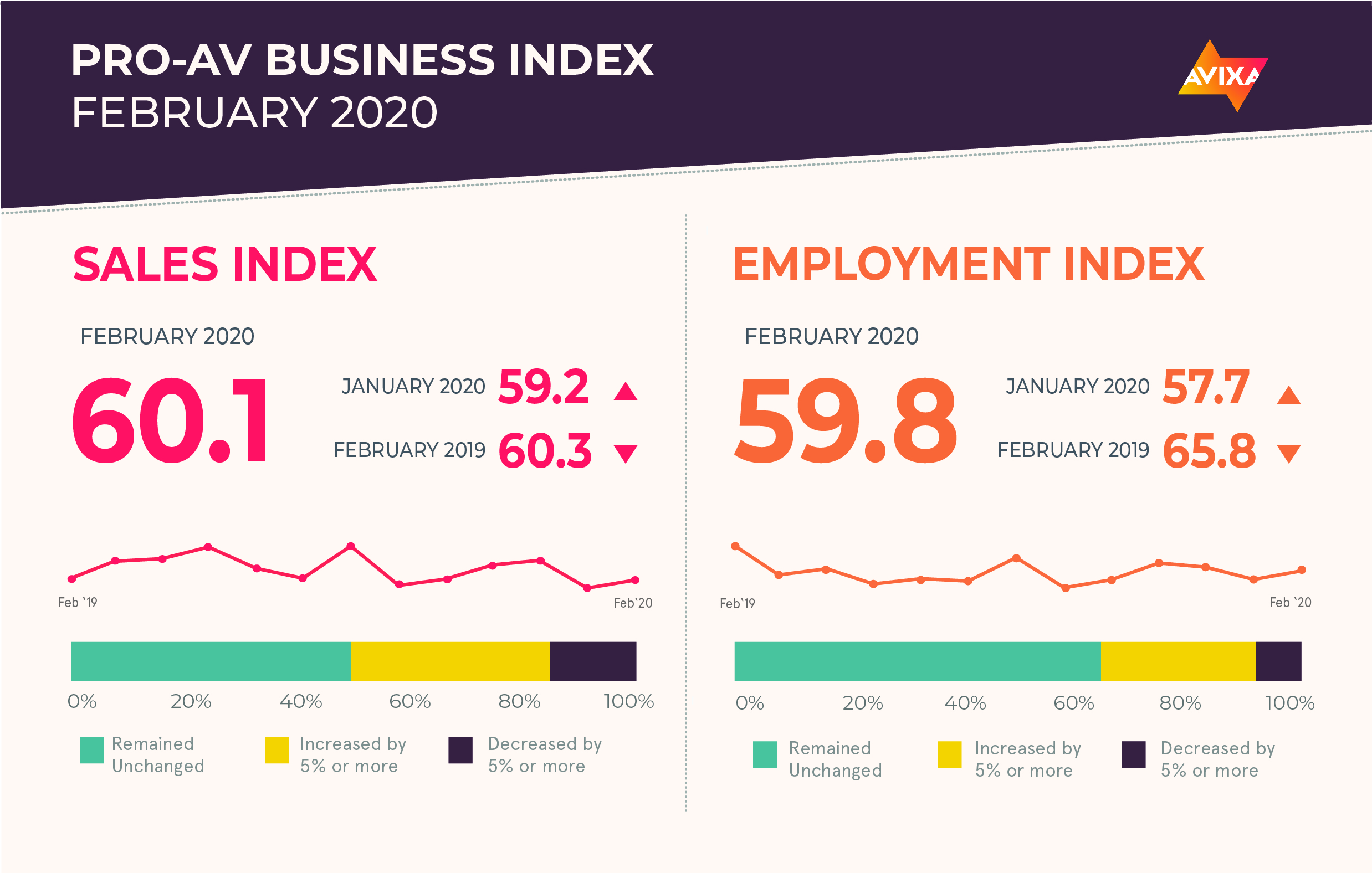

The economic shock from coronavirus hasn’t hit the pro AV industry yet, according to AVIXA’s latest Pro AV Business Index. Sales growth stayed roughly flat in February, sliding up just under one point to 60.1. This score is nearly the same as last year, when the index was at 60.3. Survey respondents did mention the first signs of the impact, as supply issues began to crop up. As of the end of February though, the virus’ impact hadn’t yet hit demand too hard. Unfortunately, that will likely begin to show soon.

For now, the AV community is concerned, but not panicking about the coronavirus. A poll to AVIXA’s Insights Community revealed that about 60 percent anticipate a somewhat negative effect on the AV industry, against 23 percent anticipating a very negative effect, and 17 percent anticipating no negative effect. From an economic perspective, this moderate level of concern is justified. While the coronavirus is a hugely uncertain event, it has the potential to be addressed in the short term. It is not a fundamental flaw in the wider economy—unlike the housing bubble that triggered the last recession. If the need for physical separation lasts for more than a month or two, though, the economic impact could get extremely serious.

“Unfortunately, the historically prolonged stretch of economic growth in the U.S. is now at risk,” said Peter Hansen, economic analyst, AVIXA. “The second quarter looks nearly certain to see economic contraction. If the contraction starts in the first quarter or lasts into the third, that would register as the first recession since 2009. For pro AV, our research shows that recessions are serious but not calamitous. Pro AV can be expected to drop about the same amount as GDP does.”

February saw the AV Employment Index edge up 2.1 points to reach 59.8. This increasing pace of AV job growth was matched by an increase in the pace of overall U.S. job growth, as the employment report showed 273,000 new jobs added. This well exceeded expectations of about 175,000 jobs. In further good news, the January number was revised up from 225,000 to 273,000. Against this optimism, it’s worth noting that such employment numbers are a lagging indicator, as the decision cycle for businesses to add or eliminate jobs takes place over months rather than days or weeks.

The Pro-AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report actually comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.

To stay up to date with the impact of coronavirus on pro AV, subscribe to our enews.