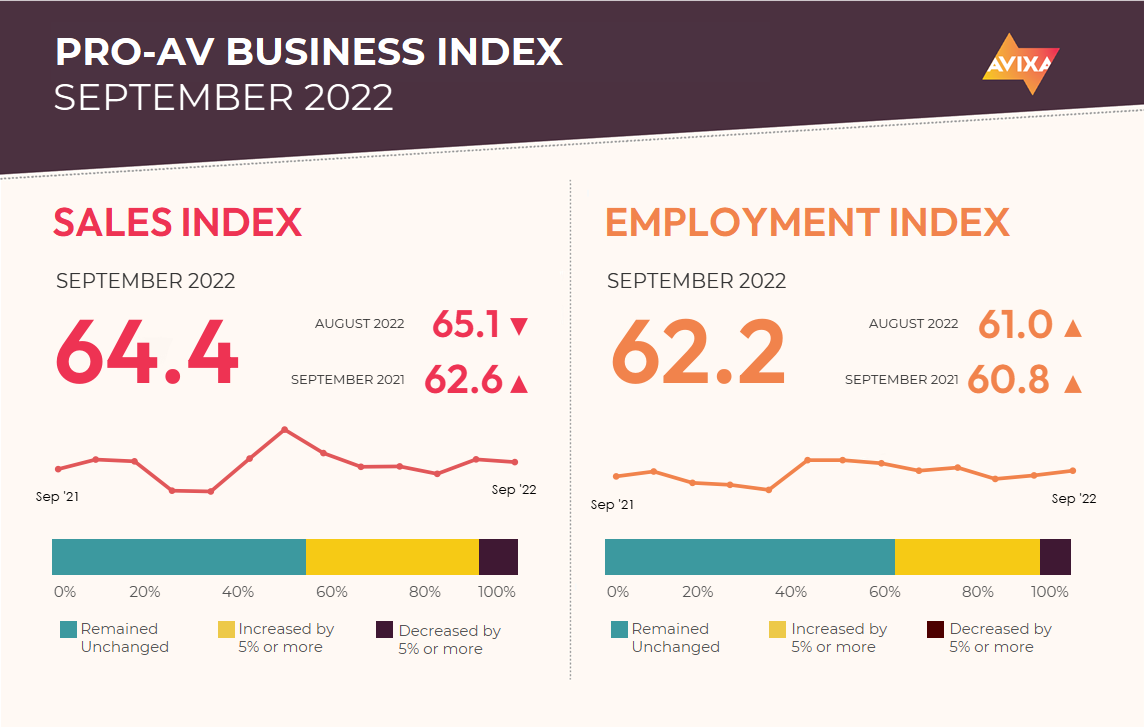

The August AV Sales Index (AVI-S) of 65.1 seemed surprisingly high given intensifying economic headwinds and recent months of lower scores. We predicted a reduction. Well, technically the September AVI-S is lower at 64.4. But the subtle, 0.7 point downshift should be seen more as a sign that the strength suggested in August is real.

“Pro AV continues to grow quickly, even as the overall economy wavers,” said Peter Hansen, economist, AVIXA. “The comments from survey respondents make it clear that returning to in-person remains a driver of spending, whether it is for live events, corporate office space, hospitality, or others. The slower growth observed in June and July seemed to suggest this tailwind was blowing itself out, but the additional data shows that is untrue. On the negative side, workforce difficulties and especially supply chains stood out as the biggest ongoing business challenges.”

[Viewpoint: This Is How It Is Now]

A new factor was mentioned by a few commenters this month: exchange rates. For years, exchange rates among major currencies have been stable enough that their evolutions—even if significant over time—never stood out. That has changed.

This year, major currencies have shifted dramatically, with a strengthening U.S. dollar the biggest trend. Higher interest rates instituted by the U.S. Federal Reserve Board make dollar-dominated bonds a newly attractive saving vehicle, creating demand for USD to purchase these assets. So far this year, the dollar has strengthened roughly 15% against the Euro, 12% against the Chinese Yuan, 26% against the Japanese Yen, and 19% against the British Pound.

[AVIXA Releases New Image System Contrast Ratio Standard]

These shifts substantially affect equipment costs. For the United States, it makes foreign-produced products cheaper. In Japan, where the Yen has weakened so substantially, foreign-produced products are more expensive. In the EU and China, U.S. products are more expensive while Japanese ones are cheaper.

Pro AV hiring improved again in September, as the AV Employment Index (AVI-E) accelerated from 61.0 to 62.2. This comes amidst a backdrop of serious difficulty, difficulty that centers on hiring as revealed in our just-released Q3 Macroeconomic Trends Analysis (META) report. These high numbers in the AVI-E indicate continued and perhaps marginally worsening conditions for retention.

In the wider economy, there are now signs of deceleration amidst a still-hot market. U.S. job openings in dropped by just over 1 million in August (the most recent release), though the level remains historically high—especially when compared to the number of available workers. The U.S. economy added 263,000 jobs in September, a figure that is the lowest in a year but would have been high at any point in the decade leading up to the pandemic. To reiterate, the labor market is shifting, but demand for workers continues to substantially outstrip supply.

[Why It's Time for a Change for Integrators]

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.