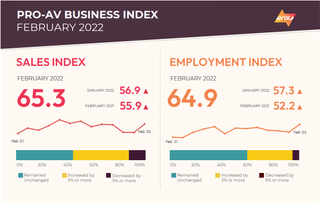

Omicron dented AV sales growth, causing modest expansion in December and January. But with the global case counts firmly on the downslope, AVIXA’s Pro AV Business Index showed renewed sales progress in February. The AV Sales Index (AVI-S) hit 65.3, which is 8.4 points above the January level, representing a substantial acceleration in the rate of revenue increase. It’s also right in line with the growth rates observed prior to the Omicron wave in October and November. Going forward, strong growth will continue, though further deceleration is possible since fewer businesses will be bouncing back from the Omicron wave.

That said, companies continued to cite COVID-19 as a significant barrier to growth, though less than last month and less than complaints about supply chains. Respondents mentioned the war in Ukraine, too, though more as a driver of uncertainty and hesitation rather than a clear disruptor so far.

Russia’s invasion of Ukraine and the sanctions it has kicked off are permeating the global economy. Russia’s economy is in freefall, while most of the rest of the world is paying a fairly moderate price. For example, the S&P 500 is down about 4.5 percent from mid-February. Countries with more economic exposure to Russia are faring worse, with the German stock market down 17 percent. Lack of participation in sanctions is not a certain insulator against economic consequences, as the Shanghai Composite Index has dropped some 5 percent since mid-February despite China’s neutral stance.

“For Pro AV, we anticipate relatively little impact. Eastern European markets will feel the most effects, and supply chain issues face some level of risk,” said Peter Hansen, economist for AVIXA. “One Pro AV aspect that does stand to be negatively impacted is content management systems, as many provider companies rely heavily on staff in Belarus, Russia, and Ukraine. That said, CMS represents only a small fraction of total Pro AV revenue, minimizing our industry’s overall hit.”

Pro AV employment boom? February saw the AV employment index (AVI-E) record the most rapid payroll expansion since the pandemic and the fourth fastest expansion in the life of the index. At 64.9, the AVI-E was just 1.1 points below its all-time record of 66.0. Though it is fractionally lower than the AVI-S level, it’s a more impressive figure due to the fact that employment is typically much steadier than sales.

[The Big Quit Will Be…Televised on TikTok?]

Since last spring, AVIXA analysts have been warning that though AV was running behind the overall economy, a hiring squeeze was coming all the same. Right now, the evidence shows it has started to arrive. Relatedly, overall job growth is also strong, with the U.S. economy adding 678,000 jobs in February as the unemployment rate fell to a pandemic low of 3.8 percent. Tellingly, the job growth was greatly driven by leisure and hospitality, which added 179,000 new jobs. People have not returned to pre-pandemic norms in the experiential economy, but there is momentum toward it.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.