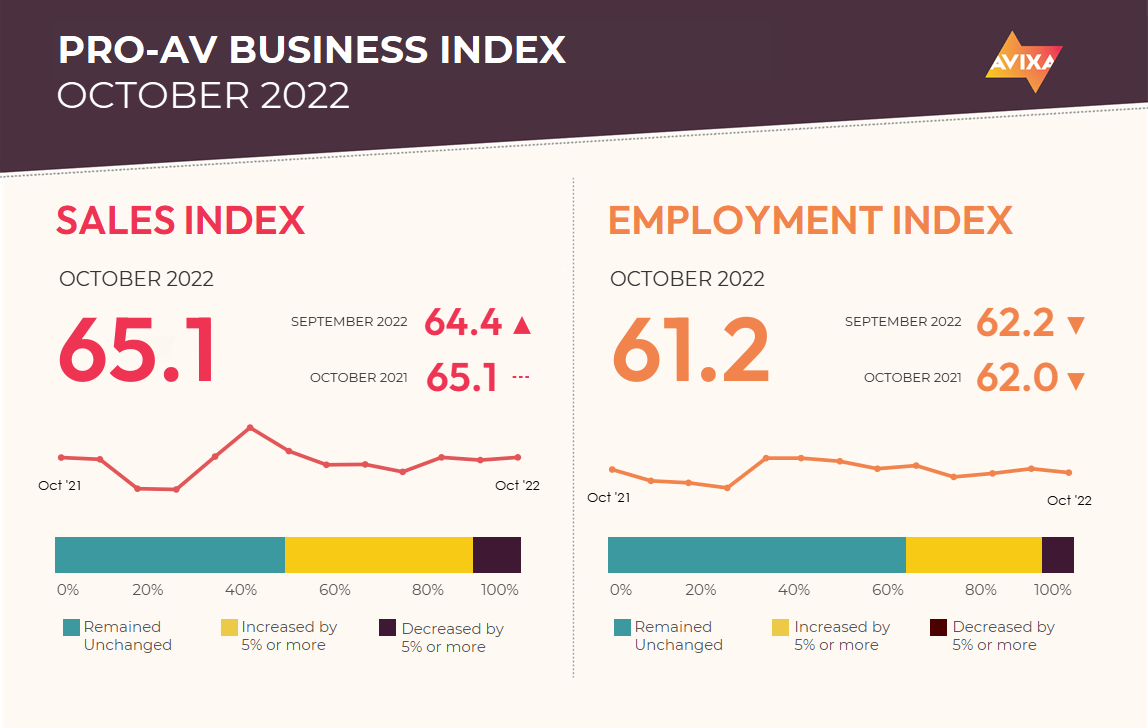

In AVIXA’s monthly Pro AV Business Index, May to July showed the AV Sales Index (AVI-S) on a steady trend of moderation, with growth slowing from a record score of 72.7 to a strong but historically normal 61.4. When the index popped back up to 65.1 in August, the preceding months made AVIXA analysts think blip rather than trend. But that August level—high growth above what was common pre-pandemic—has proven entirely true.

In September, the AVI-S was a very similar 64.4, and in October it popped right back to 65.1. These consistently high scores have the AVI-S on pace for its highest average year of all time. The latest number comes against a backdrop of negative comments. Supply remains the lead concern, though it has plenty of company from hiring issues, COVID-19, recession concerns, and political worries.

[Big-League AV Comes to Single-A for Gameday at Chukchansi Park]

Supply remains at the top of the issue list for the AV industry. The ongoing troubles are causing a discussion of moving from “just in time” to “just in case.” There is genuine wisdom in this shift, but it’s important to consider the associated warehousing costs.

“Our research shows consumers are increasingly price sensitive, so caution is wise for investing in 'just in case,'” said Peter Hansen, economist, AVIXA. “Looking ahead to next year, having significant supply on hand risks burning companies. If the likely recession materializes, and especially if it turns out worse than expected, excess inventory could put you in a vulnerable position. ‘Just in case’ may be the correct strategy, but think carefully about what products are both critical and potentially at risk—ones with no easy substitute, ones where you have limited visibility into the sourcing, etc.—and consider limiting warehousing to these selected goods.”

October marked another strong month for hiring in Pro AV. At 61.2, the AV Employment Index (AVI-E) was very similar to the 62.2 observed in September and the 61.0 observed in August. Just as for the AVI-S, the AVI-E is on pace for a record year of expansion.

The strength in hiring markets is an economy-wide phenomenon, too. The latest U.S. employment numbers reveal an addition of 261,000 jobs, a strong rate that signals a still robust labor market despite economic concerns. The unemployment rate ticked up from 3.5 to 3.7 percent, as an influx into the labor market outpaced the job gains.

[Productivity Starts at the Desktop]

Overall, this is a strong report. Job gains are welcome, and so is the return of people to the workforce. While the labor market is only one component of inflation, seeing supply and demand come into closer equilibrium could help cool prices.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.