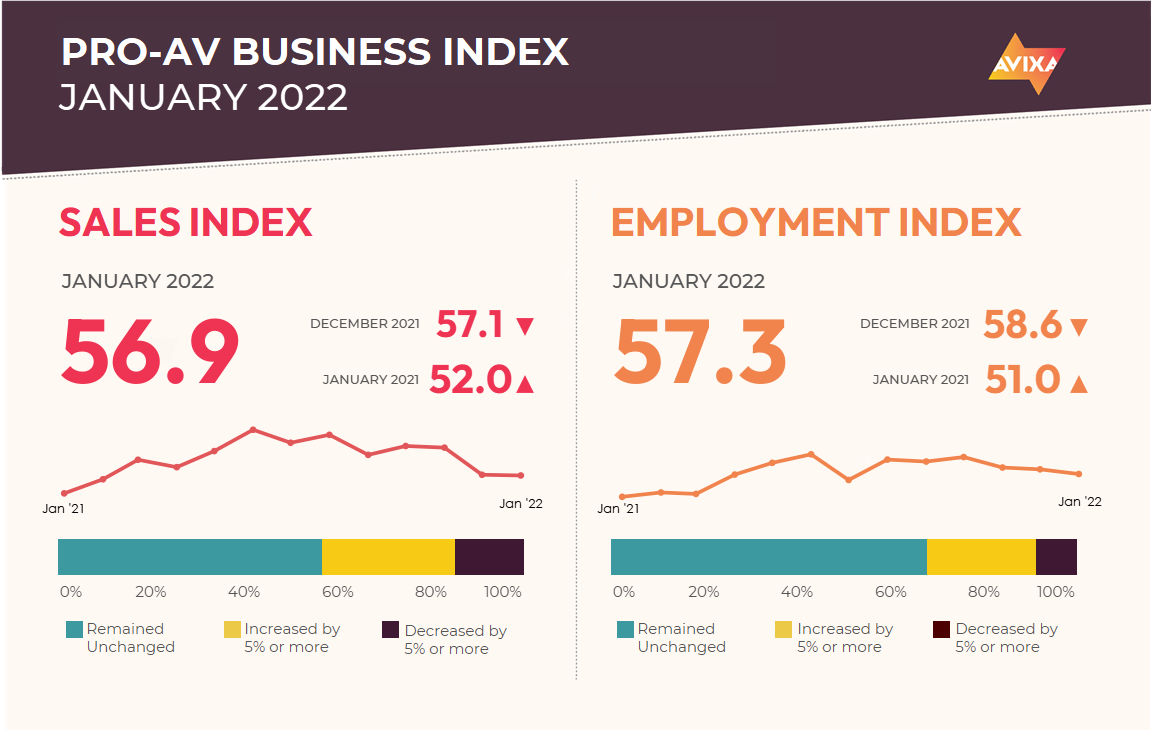

With the Omicron wave on its downslope, AVIXA analysts can now report that the Omicron variant managed only to moderate the pace of AV sales growth. In the January Pro AV Business Index, the AV Sales Index (AVI-S) registered 56.9, almost identical to the rate observed while Omicron was rising in December. For comparison, the January 2021 AVI-S was at 52.0.

[AVIXA Launches Online-Proctored CTS Exams]

Survey respondents confirmed the effect of variant, citing postponements of return to office and another measure of uncertainty about plans for live events. Also significant are supply chain issues. For some, they’re an annoyance, where business happens on longer timelines but still in a welcome volume. For a few, they’re a significant hindrance impacting the bottom line. AVIXA analysts don’t anticipate the supply issues resolving quickly but believe things will generally improve throughout 2022. But if demand spikes for certain solution areas—live events, for example—it will create supply shortages for that specific segment.

January’s survey asked providers to share their expectations for 2022 revenues compared to 2021. Translating that into a predictive AVI-S, it comes to a value of 74.9. That reflects that 57.3 percent expect sales growth over 5 percent, and just 7.5 percent predict a decrease of more than 5 percent. Even in a challenging moment for our industry, optimism abounds.

[Workers Aren’t Ready to Return to the Office]

Employment growth is in the offing, too—73 percent of providers expect to add new workers, against just 17 percent who do not (10 percent responded “Don’t know”), and 44 percent of end users are planning to add AV workers as well.

“Hiring could be a pain point for AV this year. With so many companies seeking to hire at once, placed against a backdrop of worker scarcity—especially in the U.S.—it won’t be easy to find great candidates,” said Peter Hansen, economist, AVIXA. “Starting your search early is a good countermeasure, as it will give you time to recruit more candidates and help you get to the best options before your competitors do.”

Steadiness in sales extended to employment in January, as the AV employment index (AVI-E) measured 57.3. This was just over a point lower than the December AVI-E, but well above what we saw at the start of 2021. The main takeaway for AV employment is that payrolls are steadily expanding. The AV payroll expansion occurred amidst a strong U.S. labor market, as the January jobs report showed the addition of 467,000 jobs, along with upward revisions for the November and December reports totaling 709,000 jobs. This one jobs report boosted numbers by almost 1.2 million!

The labor market is recovering exceptionally well, which will continue to support workers looking for work and squeeze companies seeking to hire. That said, the report also offered good news on worker availability, as unemployment ticked up from 3.9 percent to 4.0 percent. That increase reflects more people rejoining the workforce, a welcome sign of economic normality.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro-AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.