The change is good, the level is not.

In December, the AV Sales Index (AVI-S) increased by a point to 53.1. It’s always positive to see the AVI-S increase, even if it’s only a modest shift. The less positive news is the level: While 53.1 means the industry continues to grow, which is inherently good, our industry is used to higher levels, and 53.1 remains well below historic norms.

[AVIXA Report: Pro AV Expansion Slows Again]

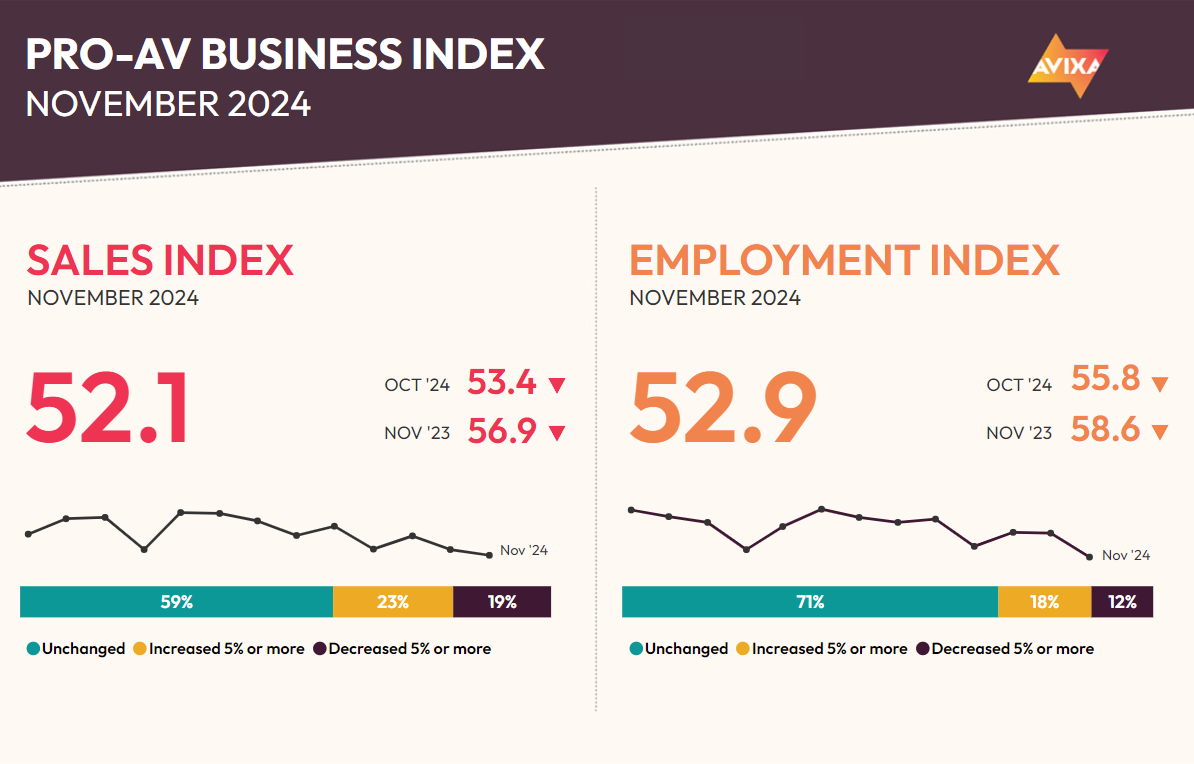

The mixed interpretation of the December AVI-S aligns with the rest of the index data in its combination of modestly positive and negative results. Survey respondents report a good year overall despite lower monthly numbers (especially of late). On the other hand, the employment side of the index saw its worst level since January 2021.

Zooming in on the details underlying the December monthly results, respondents listed familiar concerns. Some saw a quiet period due to the holidays, while others in different sectors benefited from year-end spending pushes. Hiring struggles, general economic concerns, and technology details also factored in.

At the end of the year, there are two ways we assess the year’s performance in the index: averaging the year’s performance and asking the same monthly question but in annual format (how 2024 compared to 2023). The latter is our preferred metric as it nets out monthly up-and-down fluctuations, creating a more reliable whole-year indicator.

In 2023, both indicators told a similar story: solid year, worse than 2022, but still good. In 2024, the two stories differ. The yearly average for 2024 was 56.7, which is down from 58.8 in 2023—a negative signal. However, our preferred metric, the annual change question, shows a diffusion index of 67.7 for 2024, which is essentially flat compared to the 67.1 for 2023. It’s reassuring to see respondents net out their year so positively after seeing recent months in the AVI-S so low. Yes, the monthly trend is disappointing, but the overall annual change question gives us a positive counter to the negativity of the monthly numbers.

December was a clear disappointment for the AV Employment Index (AVI-E). After dropping 2.9 points from 55.8 to 52.9 in November, the AVI-E declined a further 1.3 points to 51.6 in December. This is the lowest result since January 2021.

The caveats covered in the AVI-S discussion (and previous months of index coverage) apply here. First, with the number above 50, growth continues, and that is always good. Second, the market is in a healthy place, which means that flat payrolls are essentially fine—a stark contrast to January 2021, when the industry desperately needed strong growth to rebound from the pandemic. So, it’s not all bad news even though it is a dispiritingly low result.

[Viewpoint: Managed Services Are a Must]

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.