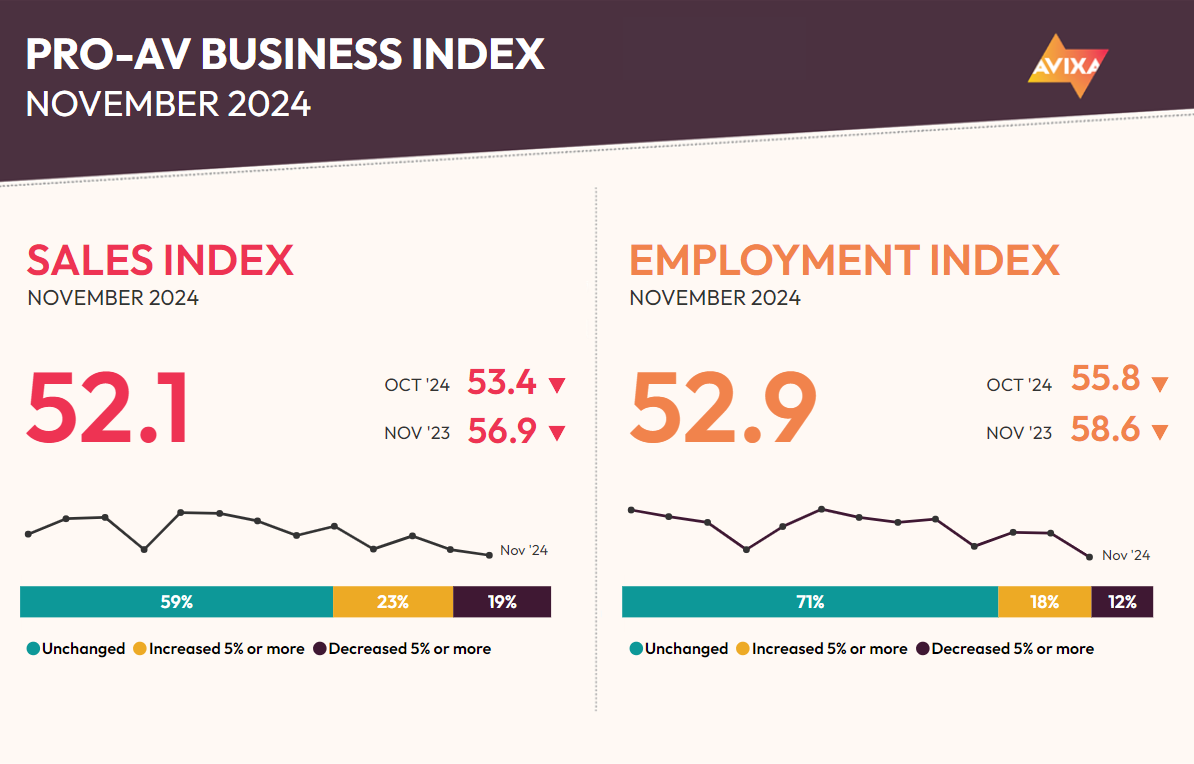

November delivered a second consecutive disappointing AV Sales Index (AVI-S). After the low result of 53.4 in October, the November AVI-S registered 52.1. On the glass-half-full side, this is still on the positive side of the no-net-change line of 50. Pro AV is still growing, but it’s inarguably slow by our industry’s long standards.

It is the lowest result since January 2021, when the world was pre-widespread vaccine and a winter COVID-19 wave was ascendant. That said, this month’s result is much better than the January 2021 result—context matters! Right now, we’re having slow growth amidst a fundamentally healthy, full employment industry. Project load and capacity are in equilibrium. That’s a stark contrast to slow growth in a struggling, pandemic-hit industry like we had in January 2021.

Zooming in on detail from commenters, we see seasonal factors as a major trend. With the end of the year approaching, many companies are scrambling to spend budget while they have it. A newly elevated concern in this month’s comments were tariffs, with fears of new costs/barriers related to President-elect Trump’s election and promises. Stay tuned on tariffs, we have more to come.

AVIXA just released our latest "State of the Pro AV Industry" annual report, which is available free to all enterprise members. The headline takeaway is no surprise to those following the index this year: Growth has fallen short of expectations, but the industry retains reasonable overall health that offers more than a few opportunities for smart companies to boost revenue. The details matter, though, so check out the full report to see where the challenges are greater and where the grass is greener.

The AV Employment Index also dropped in November, sliding from a low but solid 55.8 in October to 52.9 this month. That is the lowest result since March 2021. Comments point to how this near-50 result is a product of steadiness, with a few respondents noting how past difficulties in hiring have finally been resolved, leading to flat payrolls.

Again, this is a strong contrast to early 2021, when the industry was very much unrecovered from the COVID-19 crash and in dire need of serious growth. So, while slow growth is disappointing, the industry remains in a good position for now.

[Viewpoint: An Invitation for Collaboration]

A weakening economic context has been a primary cause of slowing Pro AV expansion, as covered here in the past. This month, the U.S. labor news was a bright spot, with 227,000 jobs added as well as upward revisions from the past two months totaling 56,000. A healthy economy is wind in our industry’s sails, so this was a positive indicator that helps strengthen expectations for coming months.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.