For months, economic concerns have centered on recession, with Q4 2022 as the likely start time. Whether that has happened—and it does not yet seem true—is far too big a conversation for AVIXA’s Pro AV Business Index. But the economy has softened, and AV reflects that.

[Supply Chain Struggles: What You Need to Know for 2023]

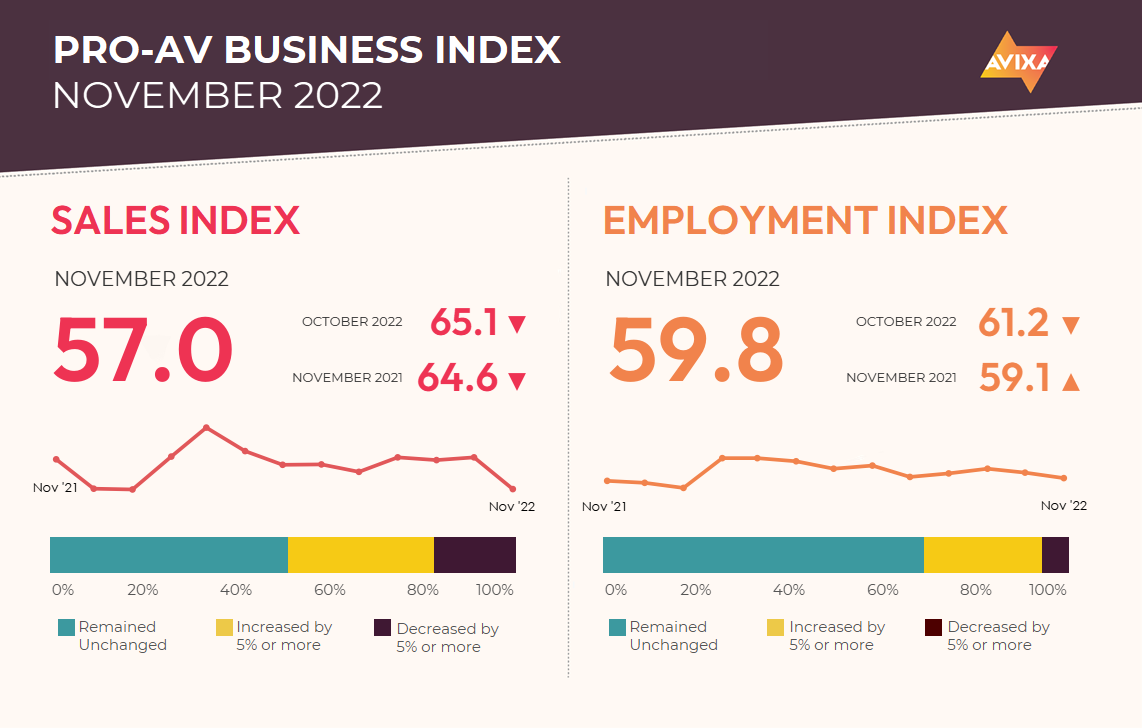

In November, the AV Sales Index (AVI-S) registered 57.0, down from 65.1 in October. This level remains firmly on the “growth” side of 50, but it is obviously a major deceleration from the previous month. Compared to numbers in the pre-pandemic years, the October mark would have been abnormally high, though not unheard of, and the November mark would have been abnormally low, though again not unheard of.

“Going forward, the trends are difficult to project. Such large changes tend to reflect noise, and you see reversion in the following month,” said Peter Hansen, economist, AVIXA. “But it’s possible that though the observed deceleration may reflect a bit of randomness, it also reflects a trend that will continue through next month and create an even lower AVI-S. Either way, the December index will be something to watch closely.”

[Viewpoint: This Is How It Is Now]

Much more positive than the AVI-S were the inflation numbers that came in this November. Both the U.S. and EU numbers showed an easing of inflation. In the EU, November was the first time in 17 months that inflation had decelerated.

In the United States, the CPI showed the fourth consecutive month of deceleration, drawing the year-to-year change down from 9.1% in June to 7.7% in October. As inflation is the primary cause of recession concerns (due to central banks responding by increasing interest rates to slow spending), seeing improvement is excellent news. However, we note that, like the lower November AVI-S, it is only one month of good data. More information will be needed to give confidence that the end of significant inflation is in sight.

The Pro AV Business Index has mentioned it several times before: Employment is a lagging indicator that moves more slowly than sales, reflecting the time needed to create a new job, search, and hire. Knowing that, we’d expect the AV Employment Index (AVI-E) not to move as much as the AVI-S. Indeed, that’s exactly what we saw.

[AVIXA Foundation Announces 2022 Scholarship Recipients]

While the AVI-S dropped 8.1 points, the AVI-E declined a modest 1.4 points, from 61.2 in October to 59.8 in November. Again, contrasting to the AVI-S, the AVI-E’s level in November is closely in line with what was normal in a pre-pandemic month. In wider employment news, U.S. employment numbers remained strong. The economy added 268,000 jobs, and employment remained steady at 3.7%, which indicates a strong and growing labor market.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.