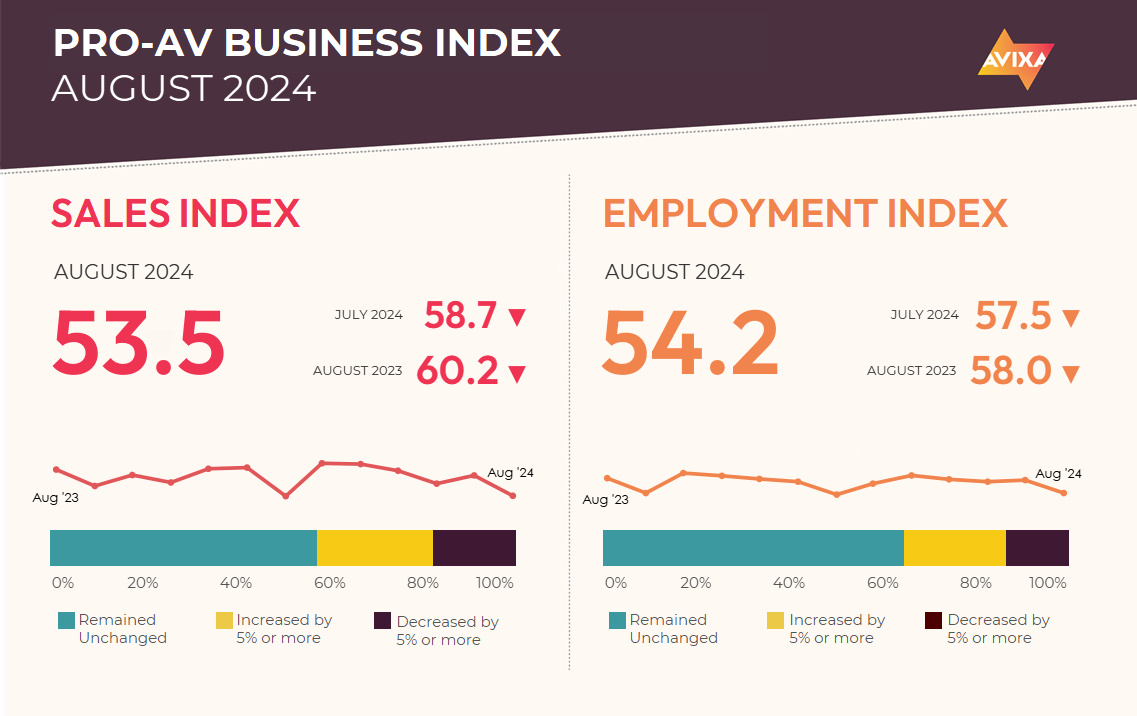

August’s reading in the Pro AV Business Index came in lower than hoped, declining to 53.5 from 58.7 in July (5.2 points). Generally, lower scores involve more respondents reporting contraction. Not so this month: The percent reporting contraction was 17.4% in July and 17.8% in August.

[AVIXA Report: Pro AV Growth Still Moderate Amid Tepid Macro Environment]

Instead, the difference was driven by a 9.4% increase in the percent reporting “no change” from month-to-month (57.3% vs 47.9%). This result is the second lowest score this year, fractionally ahead of the February score of 53.4. February’s disappointing result proved to be an aberration, with the index above 60 in the next two months. That’s too positive to expect in September and October, but we are optimistic that the index will be back in the upper 50s soon.

A change in the interest rate environment has been in the pipeline for many months. Now, it’s finally here. U.S. Federal Reserve communications and market expectations long pointed to September as the time for the first rate cut. If there was any doubt, the past month’s news has removed it. The most recent numbers confirmed declining inflation that is in close range of the Fed’s 2% target.

More critically, the Bureau of Labor Statistics released the annual update to its monthly job numbers, with a downward revision of 818,000 over 12 months (April 2023 to March 2024). Instead of an average of 242,000 jobs per month—a level strong enough to suggest an overheated economy—the average is 174,000. That's perfectly fine, but when you consider that the numbers are trending downward and that the robustness of the jobs numbers was a primary justification for delaying rate cuts, you can see why the new numbers demand Fed action.

The AV Employment Index (AVI-E) also fell in August, but more modestly than the AVI-S, dropping 3.3 points from 57.5 to 54.2. Employment reliably moves slower than sales, since these decisions are so deliberate and large. This year in particular has seen little total movement on employment (i.e., index scores closer to 50) after the post-pandemic hiring boom. Companies are not laying off workers—in fact, hiring workers remains difficult. But by and large, companies are maintaining steady payrolls.

That steadiness is increased by low quit levels. Essentially, after the large post-pandemic rebound and reshuffle, things have hit equilibrium. How long will that hold? That comes down to the economy, and the economy has cooled substantially.

[On Your Business: Sales Is Not a Four-Letter Word]

If the forthcoming rate cuts steady the ship and launch healthy growth, we should see increasing revenue gains and employment gains probably starting early next year. If the shift to low interest rates turns out to be too late, we could enter a rough patch soon. The positive scenario is more likely, but only time will tell.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.