Is the September AV Sales Index (AVI-S) good news or bad news? Like beauty, this one is in the eye of the beholder.

[AVIXA Report: Large Increase in ‘No Change’ Drives Lower Index]

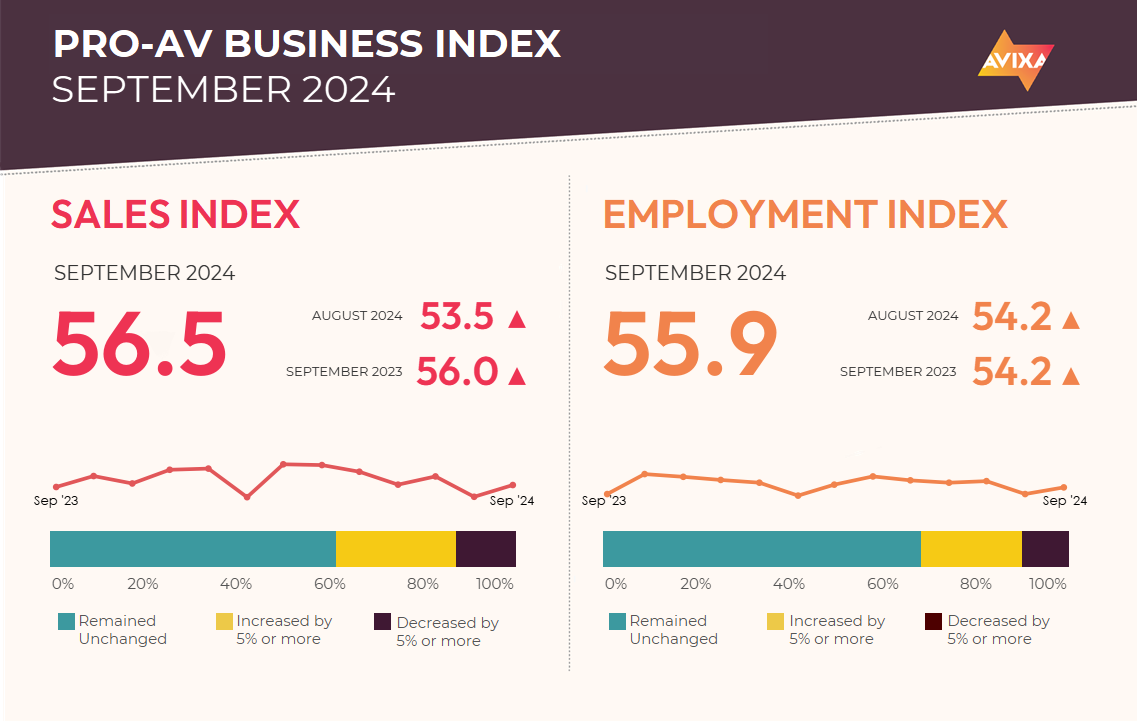

August was unequivocally disappointing: Driven by a large increase in the percent of respondents reporting no change, the index fell to 53.5, essentially tied for the worst score since January 2021. This month, the index rebounded to 56.5. The increase of three points is good news—but 56.5 is the third lowest score of the last 12 months and comfortably below what is normal for the index. That’s bad news.

If you expected a similar score to the disappointing August result, you’re happy. But if you were hoping for something closer to what has been normal for the last year, you’re unhappy. Realistically, the observed 56.5 is about what we should be expecting. The economy has cooled and the post-COVID rebound has ended, so modest growth is the most likely scenario.

Interestingly, comments focused on a wide array of business issues rather than specific external factors. They were much more concerned with customer knowledge, product details, and seasonal factors than with broad economic weakness, geopolitical issues, or other usual reasons for as low an AVI-S as this month. We interpret the focus on individual business conditions as confirmation of the relatively neutral environment. There is neither headwind nor tailwind strong enough to earn many comments. Instead, success is determined by more subtle market and company-specific factors.

[On Your Business: Technology Isn't Enough]

AVIXA’s quarterly Market Opportunity Analysis Report (MOAR) fleshes out the story of Pro AV spending in recent months. The MOAR series dives into end user perspective on spending, including spending plans for the coming quarter. At the highest level, the MOAR aligns closely with the AVI-S, pointing to overall growth but at a level that is slower than in the past.

As you dive into the details, the story gains complexity. For developed countries like the United States, reports tended to focus on steadiness. In developing countries, the responses pointed more toward continued growth, but at lower rates than in past quarters. The MOAR covers a tremendous variation in end user types, project types, and geographies, so the full resource has extensive nuance to the overall story of continued but declining growth.

The AV Employment Index (AVI-E) continued moving in tandem with the AVI-S. It accelerated 1.7 points from 54.2 in August to 55.9 in September. This is a smaller acceleration than the AVI-S, and that leaves the AVI-E closer to the no-net change line of 50. But this is as expected given that employment is reliably more stable than sales, with smaller fluctuations and values on average closer to 50.

Outside of AV, the employment news was strong. In last month’s index report, we focused on how the macro environment has cooled. That remains true, but the U.S. September Jobs Report is a big bright spot, with unemployment falling from 4.2% to 4.1% and the economy adding 254,000 jobs. This was easily the best report since March, and it throws a nice splash of cold water onto fears the global economy is near recession.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.