AVIXA Report: Disappointing Deceleration for Pro AV

Integrators continue to face supply and hiring issues.

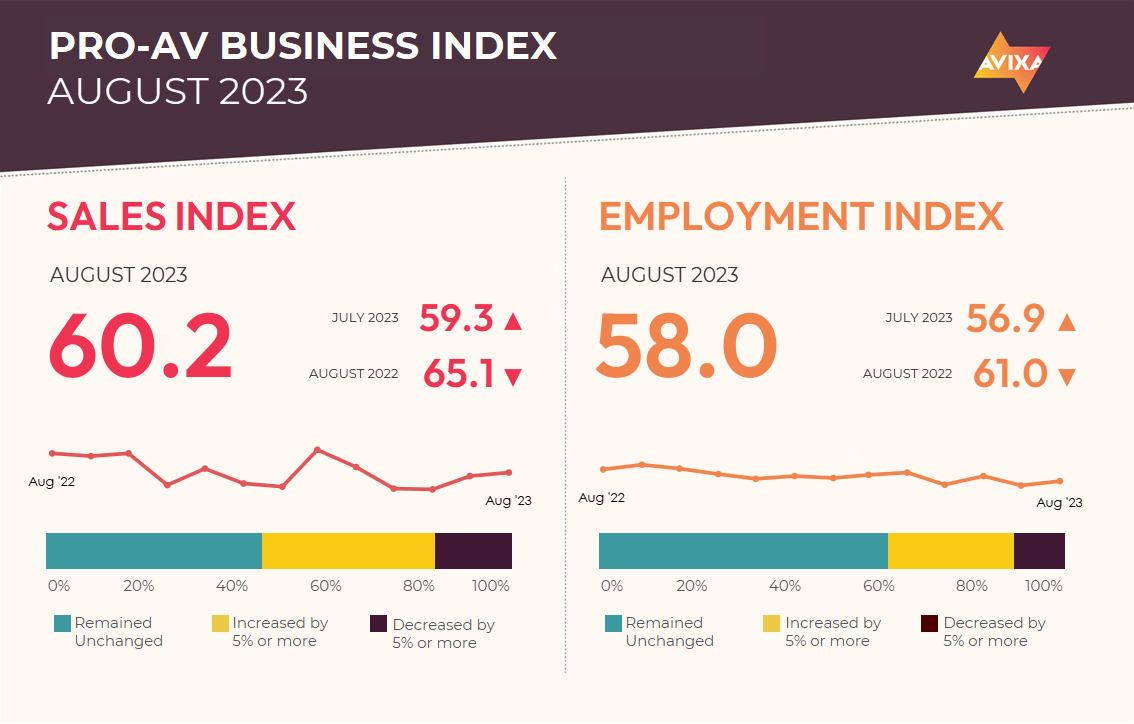

The September numbers from our global AV Insights Community have come in disappointingly low. On the revenue side, the AV Sales Index (AVI-S) registered 56.0, consistent with modest growth. It’s not the lowest level this year—June saw a rate of 55.9—but it is near the bottom for the year and low compared to most non-recession periods.

It’s not overly surprising to see the index at this level; as covered previously, 2023 is marked by global economic weakness. That said, the macroeconomy has avoided most recession fears, and news over the summer has been relatively positive. As a result, such a mediocre result for Pro AV is a disappointment.

Survey respondents shared a variety of challenges. Many are still held up by supply limitations. Hiring issues are common, too. Weak demand, likely stemming from the macroeconomy, was also repeatedly cited in some form or another.

Globally, the lead diffusion index is the PMI, or Purchase Managers Index. Like our AV diffusion index, these indexes are a real-time measure of growth, where values over 50 show expansion and under show contraction. The global flavors of this index highlight economic weakness and regional unevenness. For September in the Eurozone, the composite PMI (which covers manufacturing and services) measured 47.2, indicating very modest contraction. In the United States, the equivalent figure was essentially flat at 50.2; in China, it was slightly higher at 50.9.

In short, a lot of mediocrity, with Europe bringing up the rear. Importantly, each of these PMIs has averaged in the low 50s for the last decade, which means the current low scores aren’t as much of a disappointment as they would be for our industry’s diffusion indexes. Still, they underscore the challenges in the current macro environment.

Early in the year, the AV Employment Index (AVI-E) was often higher than the AVI-S. This abnormality reflected lingering staffing needs after the major runup in AV activity last year—especially amidst an exceptionally challenging hiring market. Recent months seem to indicate that AV firms are now mostly caught up.

In September, the AVI-E measured 54.2, 1.8 below the AVI-S. This was the slowest hiring expansion observed since April 2021. Interestingly, the AV numbers contrasted with the U.S. economy, where a surprising and impressive 336,000 new jobs were added. The September expansion also contrasted with previous months of U.S. jobs data, which averaged a much more normal 200,000. The September U.S. figure is most likely a blip rather than a trend, with AV and the wider economy both settling into slower expansion rates in line with the overall mediocre macroeconomy.

A daily selection of the top stories for AV integrators, resellers and consultants. Sign up below.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Peter Hansen is an economist at AVIXA.