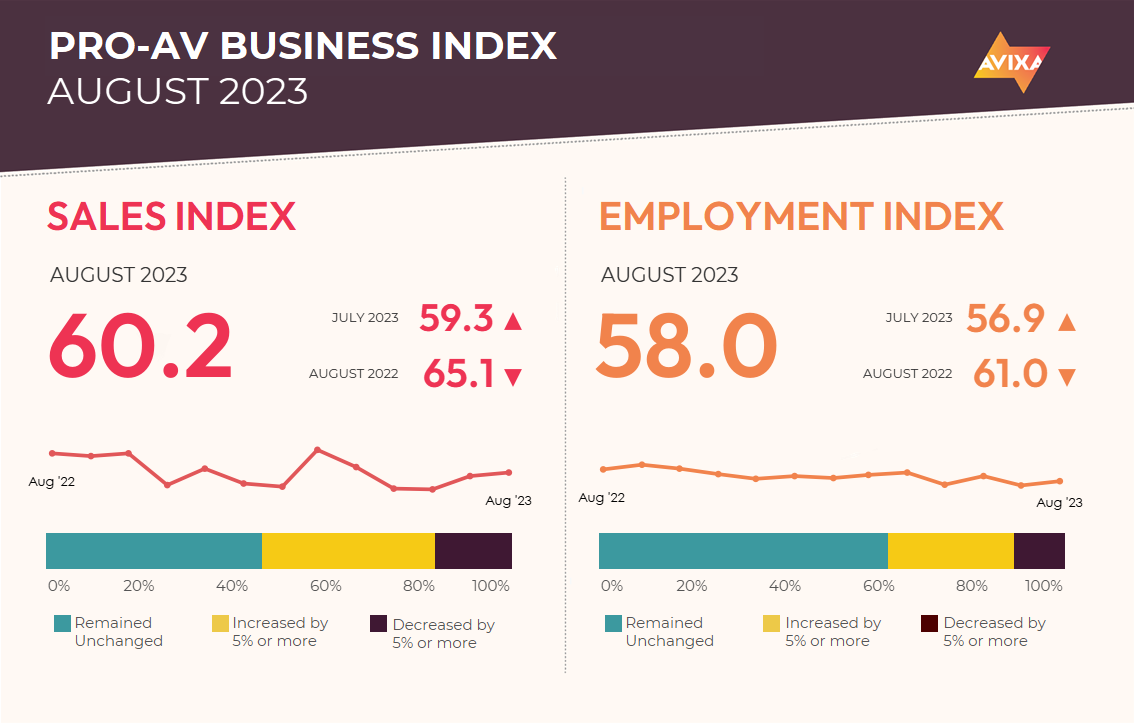

Last month, our Pro AV Business Index report focused on the news of the improving global macroeconomy. That positivity continues in the AV sales index (AVI-S), which moved up about a point from 59.3 to 60.2. So far in 2023, the AVI-S has averaged 59.1, so this month is a touch better than the growth we’ve measured this year.

We note that this growth hasn’t been equally shared across all sectors. On the positive side, live events are experiencing strong growth as they consolidate financial gains from the return to in-person. On the negative side, certain products are in oversupply as supply chain issues ease, leaving some companies disappointed in their bottom lines.

[AVIXA Report: Have We Stuck the Soft Landing?]

Survey respondents highlighted many positive and negative trends this month. Several comments focused on the return to office, including clients firming up long-term return-to-office plans and the associated AV needs. This remains a key area of uncertainty for our industry, especially since corporate offices are our industry’s largest vertical market.

Technological advances and COVID-related workflow shifts have created unusually high levels of new, untapped, and undeveloped market opportunities: adding AI into conferencing and collaboration, taking advantage of avatars in virtual meetings, diving into the immersive potential of esports, and more. However, our data suggests the AV community continues to focus on more traditional spaces. A majority of our Insights Community report that VR, esports, and virtual production present little to no opportunity for their business over the next five years. By comparison, just 25% feel that way about control rooms. If the crowd is reticent to jump into promising new spaces, an unusually large market share could be available to ambitious first-movers.

Like the AVI-S, the AV Employment Index (AVI-E) also ticked up modestly this month, accelerating from 56.9 in July to 58.0 in August. This represents a steady expansion of payrolls. Notably, hiring remains difficult. Hiring new employees was once again the second biggest challenge reported by respondents, just five percentage points behind supply chains.

The persistent moderate growth mirrors what is happening on the broader labor market in the United States. According to the Bureau of Labor Statistics, payrolls added 187,000 jobs in August—roughly normal for the pre-pandemic years—as unemployment edged up to 3.8%. Not all labor markets are so strong. In China, the world’s second largest economy, unemployment is a growing issue. Youth unemployment is particularly troubling, at over 20% in June before the government stopped breaking down unemployment by age in July.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.