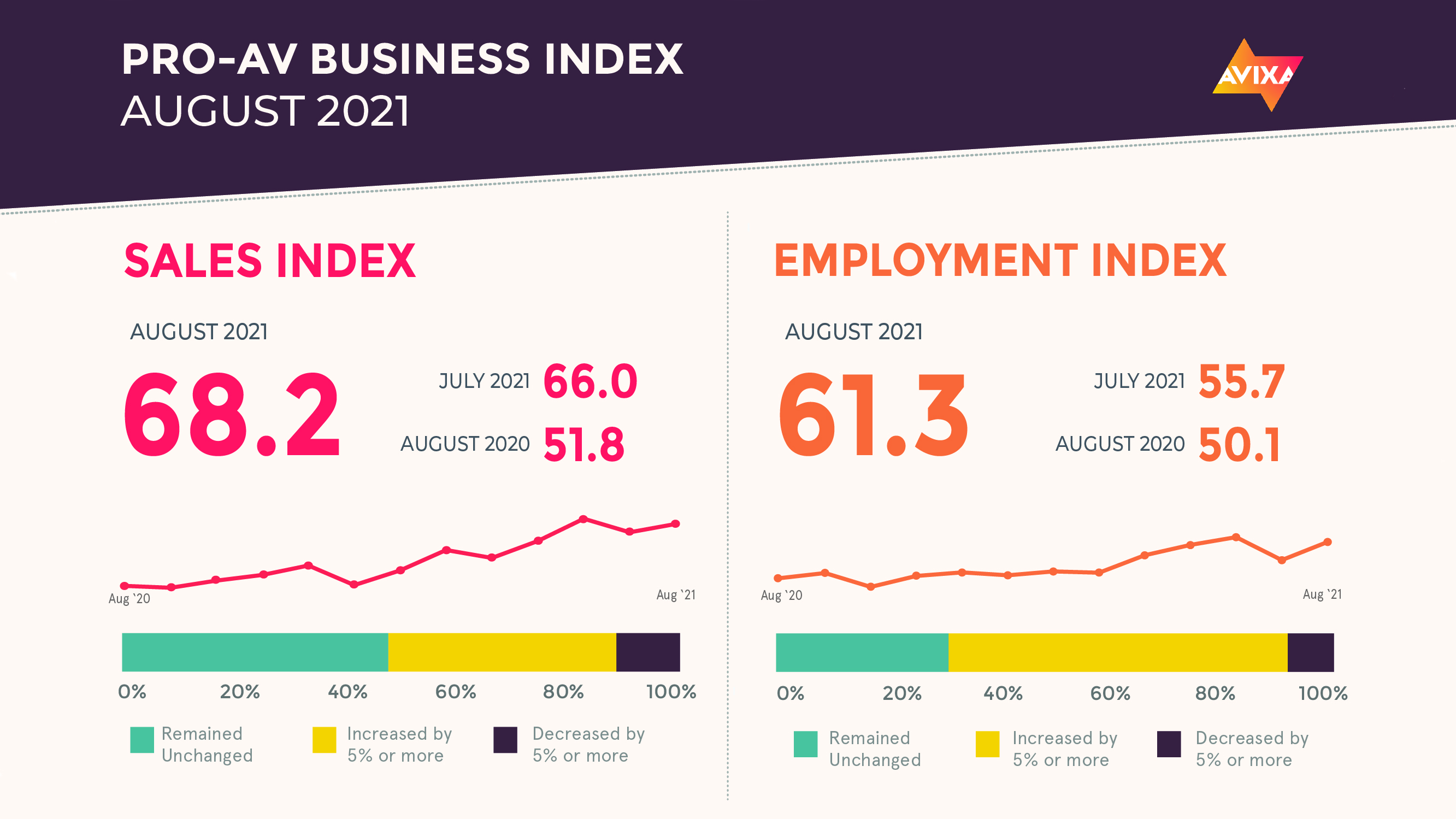

AVIXA’s latest Pro AV Business Index shows strong growth continued in August, with the AV Sales Index (AVI-S) registering at 68.2. This month’s high pace of growth meant that the three-month average this summer was 67.9, the highest three-month average for any period in the history of Pro AV Business Index. The 68.2 August mark was also an acceleration from July, when the index registered a still rapid 66.0.

Despite growth, there were many negative comments from survey respondents, which primarily referenced either the coronavirus delta variant or supply difficulties. The silver lining to the negative comments is that the pinch from these two negatives is likely temporary, with COVID-19 case counts appearing to have just passed their peak (as of mid-September) and recent AVIXA research suggesting supply issues will show improvement in most areas by the start of 2022.

“One advantage of the supply issues AV companies are facing is that they are, in a sense, treatable,” said Peter Hansen, economic analyst, AVIXA. “In other words, companies have a lot of tactics they can deploy to respond to the challenges. We go into way more detail in our recent report, but one strategy that our data shows has proven unexpectedly successful is passing along price increases to consumers.”

A large piece of the current supply trouble is the rising cost of shipping. The Frieghtos Baltic Index Global Container Freight Index reached its highest weekly close in history on Sept. 10, a level more than 5x higher than the same point in 2020 and almost 10x higher than the same point in 2019. In the AVIXA report Hansen mentions, AVIXA found that while microchips have been commonly cited as the primary cause of AV supply difficulties, the pandemic, economic uncertainty, and rebounding demand were all more significant causes. The freight prices are a direct product of these causes, as they largely reflect pandemic-caused port and border closures, with this summer’s demand rebound an exacerbating factor.

Before August, the July AV Employment Index (AVI-E) was a disappointment, coming in substantially lower than June and showing only modest payroll growth. In the write-up about the results, AVIXA analysts predicted a rebound for August. Happily, we can now report that a rebound is exactly what happened, as the AVI-E accelerated from 55.7 in July to 61.3 in August. In the wider economy, the news was less positive. The U.S. employment market added only 235,000 jobs in August, well under the 720,000 that economists had been predicting. The leisure and hospitality sector was one of the harder hit sectors in August, while education and professional and business services added significant numbers of jobs. Integrators and AV suppliers can expect to see some of this pattern reflected on their project pipeline in the short term.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Click here to read more stories from the October 2021 issue of SCN.