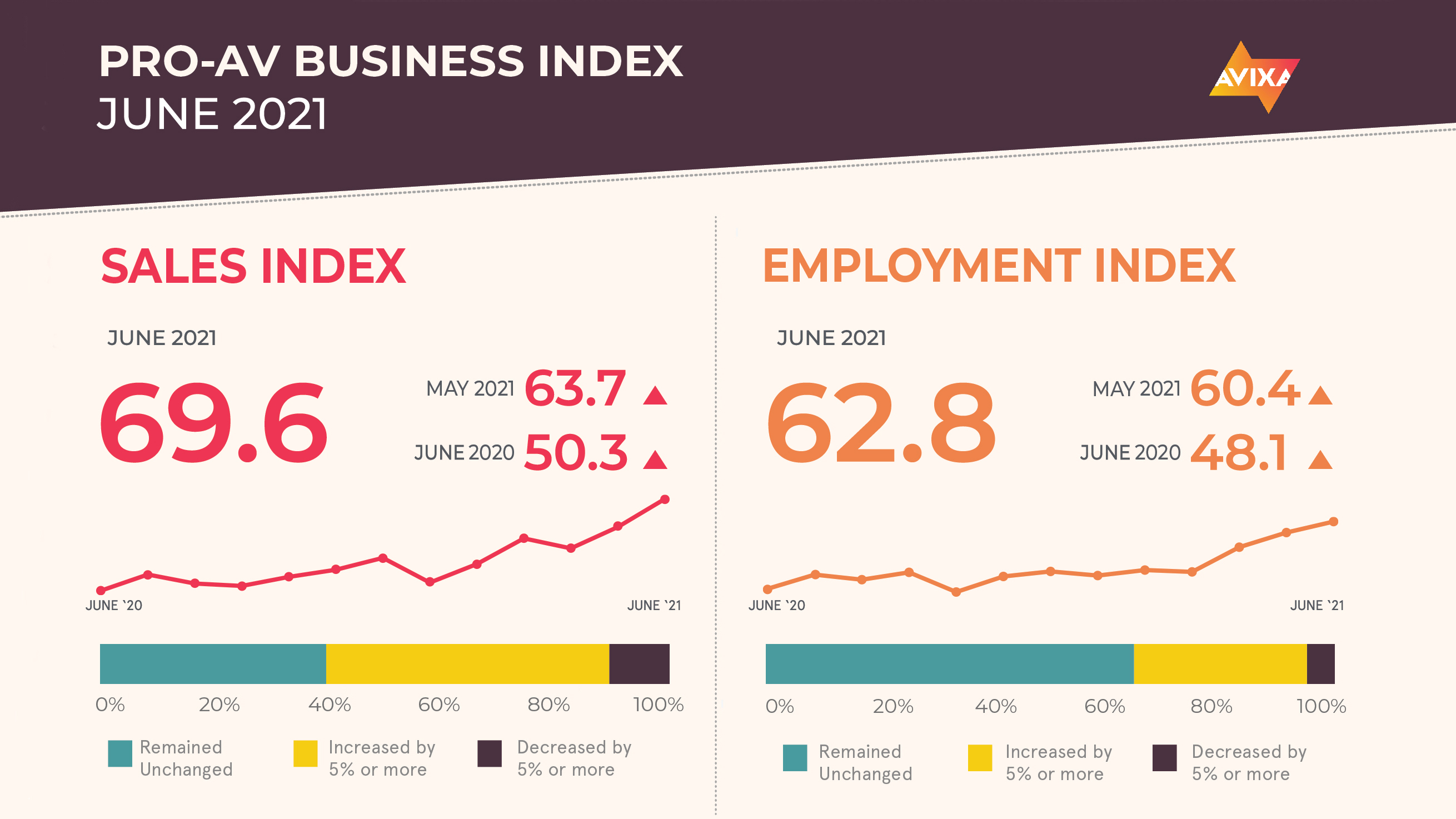

In June, AV sales growth reached its second-highest level in the nearly five-year life of AVIXA’s Pro AV Business Index. At 69.6, the June AV Sales Index (AVI-S) comes in 5.9 points higher than May. A telling sign of the industry’s growing health is that this month was the first time since the start of the pandemic that COVID-19 wasn’t by far the most cited negative business factor by survey respondents.

While the pandemic did show up in many comments, supply chain issues have taken primacy. Respondents highlighted a number of ways they’ve responded to supply challenges, with 43 percent reporting they’d passed price increases along to consumers and 37 percent reporting they’d made early purchases. AVIXA is currently working on a deep dive into supply issues and price change for the next Macroeconomic Trends Analysis (META) report, which is set to be published in late August.

“Interestingly, our data show that supply issues are not specifically a recent issue,” said Peter Hansen, economic analyst, AVIXA. “In our May poll, more respondents reported that supply issues peaked in 2020 than in spring of 2021. That’s certainly not what the headlines suggest. Why the discrepancy? We think it’s a sign of the growing positivity. Sure, AV companies had supply issues last summer, but back then, those problems were dwarfed by missing sales. Supply problems are a genuine challenge—that’s why we’ve launched a big research project on them—but that they are top of mind now is another indicator about how the worst of the pandemic has passed.”

The accelerating growth seen in the AV industry is a story being played out throughout the rest of the economy. We are moving from a state of lower economic activity to one of higher economic activity, and the speed of this transition is causing growing pains. The impacts of this conversion are felt most acutely in supply chains and employment. Producers are struggling to ramp up production and shipping companies are struggling to transport what is being produced. On the employment side, companies are seeking to hire workers to meet spiking demand but are struggling to do so as fast as they’d like. Millions of workers left the labor force during the pandemic for reasons including safety, childcare, or early retirement. The latest U.S. jobs report shows that many of the departed are finally starting to rejoin the labor force, though businesses can anticipate continued hiring challenges given the volume of increased demand.

Just as the AVI-S accelerated, so too did the AV employment index (AVI-E), which moved from 60.4 in May to 62.8 in June. 62.8 is the highest level for the AVI-E since August of 2019. All the data AVIXA analysts have collected since the start of the pandemic affirms that current staffing levels remain well below 2019 levels. That said, with all the hiring happening now both inside and outside of AV, supply is dwindling fast. Companies would be wise to hire sooner rather than later, as it will enable them to hire quality candidates at reasonable salary levels, which may not be possible come fall.

U.S. employment data shows signs of the future for our industry. In June, the U.S. economy added a massive 850,000 jobs. To facilitate these hires, companies were forced to raise wages, with average hourly pay for hotel, restaurant, and entertainment venue employees jumping 2.3 percent in June and 6 percent total in the second quarter alone. A similar runup in wages is very possible for pro AV as the number of unemployed and underemployed AV professionals declines.

[ New York Times: U.S. Added 850,000 Jobs in June, and Wages Rose ]

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit www.avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Click here to read more stories from the August 2021 issue of SCN.