This Is Refreshing: Good News for Pro AV

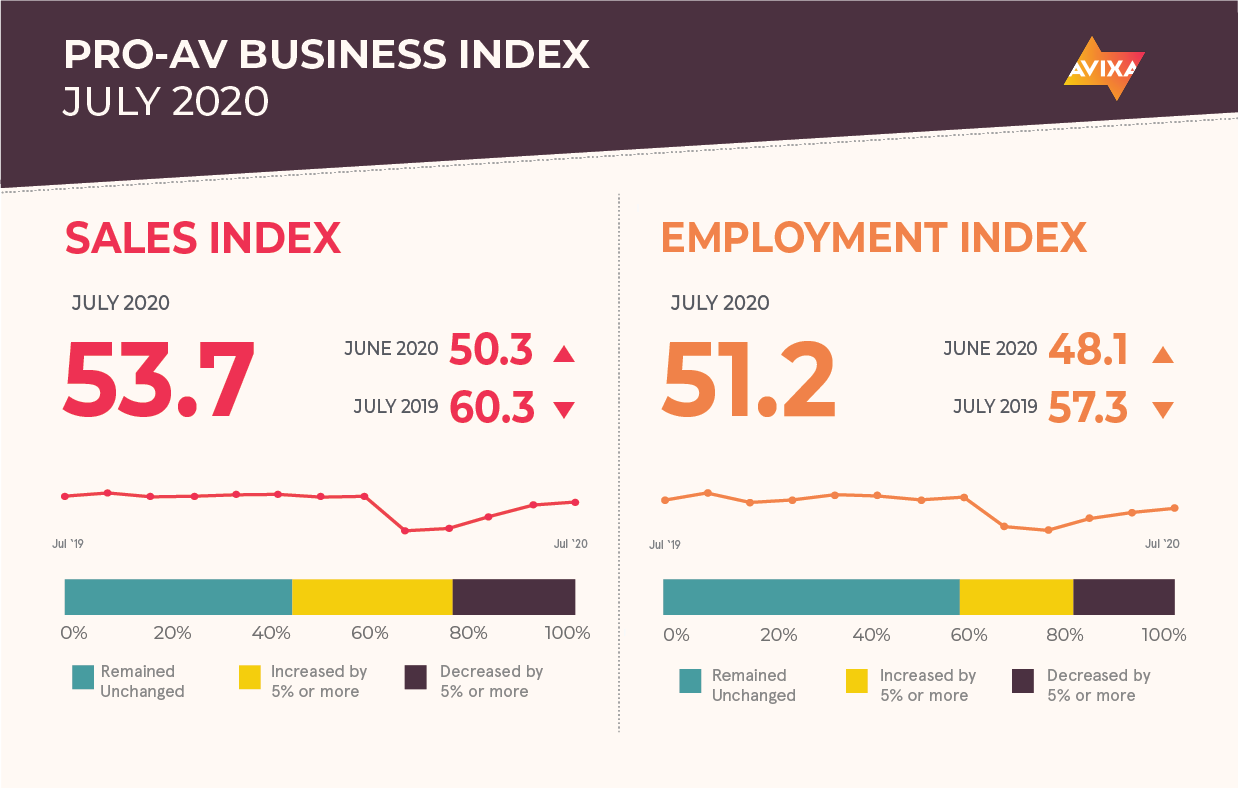

This month, the AV sales index (AVI-S) reached 53.7, indicating growth for the first time since February, according to AVIXA’s July Pro AV Business Index.

The pro AV industry has a long road ahead, but sales and employment are growing for the first time since February, according to AVIXA’s latest Pro AV Business Index. It’s not all blue skies yet, as this month represents only slow growth. But the operative word is “growth,” and all signs point to it continuing.

In July, the AV Sales Index reached 53.7. This represents an increase of 3.4 points from June, when the index’s 50.3 mark suggested no net change.

“These numbers show the recovery is starting to take hold, even despite the uptick in COVID-19 cases that is affecting our U.S. survey respondents,” said Peter Hansen, economic analyst, AVIXA. “While the momentum could be derailed by a broader or more significant wave, we have a few advantages now over March: workflows are established online, retailers and restaurants have procedures to maintain social distance and maximize cleanliness, and goods like hand sanitizer are in better supply. These improvements make our economy more robust to future virus intensifications.”

Related: AV in the Post COVID-19 World from the 2020 AV/IT Summit

The Pro AV Business Index now incorporates questions from AVIXA’s weekly COVID-19 Impact Survey that ran from March until the end of June. The top finding from the additional questions is that panelists report a year-to-date revenue decline of 20.8 percent versus the same period in 2019. Staffing was steadier, dropping 9.0 percent. Despite these big declines, providers show optimism for recovery, with a clear majority anticipating revenues to get back to pre-pandemic levels by the end of 2021, in line with the Industry Outlooks and Trends Analysis (IOTA) projections.

The AV Employment Index also turned back into growth territory in July. The index increased 3.1 points from 48.1 to 51.2. To be clear, 51.2 is so close to the no-net-change mark that it’s more a sign of steady payrolls than growth, but it is still encouraging. Comparing the survey’s international respondents to North American respondents shows that this increase was driven largely by U.S. growth.

Shifting attention to the broader U.S. economy, payrolls added 1.8 million workers—500,000 of them at restaurants and bars—as the unemployment rate dropped to 10.2 percent. As a single snapshot, these numbers are a good sign. Context makes them look less positive, though, as payroll growth shows clear signs of deceleration. Job growth in June was more than twice as fast as it was in July, and initial unemployment claims have steadied at over 1 million per week—well above the pre-pandemic record.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report actually comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.

The AVNetwork staff are storytellers focused on the professional audiovisual and technology industry. Their mission is to keep readers up-to-date on the latest AV/IT industry and product news, emerging trends, and inspiring installations.