Globally, pro AV growth continued at a slow pace in September. AVIXA’s latest Pro AV Business Index data serves as reminder of the complexity involved in the global economy. The international nature of the AV community means that even as some areas gain ground against COVID-19, others are often losing it.

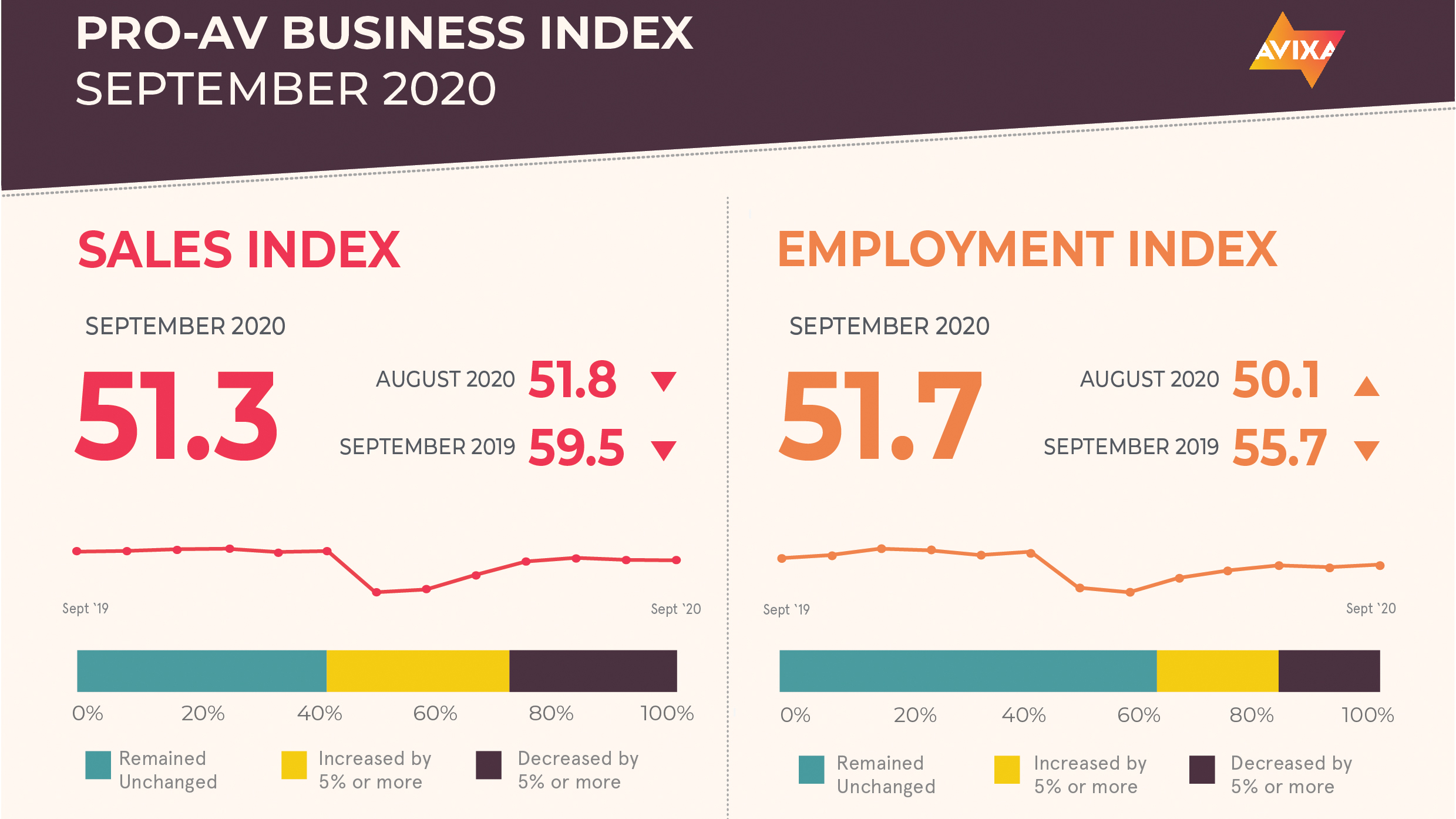

September’s AV Sales Index (AVI-S) clocked in at 51.3, just above the no-net growth of 50 and slightly below August’s 51.8. Survey responses reveal economic troubles are increasingly influencing their businesses. While optimism for recovery from COVID-19 may grow, potential AV buyers face financial difficulties and are cautious about investments.

Data on projects and recovery outlook shows a divergent picture for the AV community. In September, 32.4 percent of AV providers reported that the bulk of their projects had resumed—up substantially from 8.8 percent in early July. However, expectations for a full recovery have worsened. In July, 37 percent thought it would take at least until the second half of 2021 for revenues to get back to their 2019 level. Now 44 percent of providers expect it will take that long.

The AV employment index (AVI-E) ticked up slightly to 51.7 this month amid mixed signs on economy-wide employment. As it is greater than 50, the AVI-E mark means that AV payrolls expanded slightly in September. Payroll expansion is arguably a more positive indicator than month-to-month sales as companies only add jobs when they anticipate a durable expansion of demand, while sales may bounce around significantly during an uncertain climate.

“Intriguingly, while the AVI-E and he AVI-S had similar numerical results, the composition of responses was quite different,” said Peter Hansen, economic analyst for AVIXA. “For the AVI-E, most respondents reported flat payrolls—about 60 percent. For the AVI-S, it was the reverse, with about 60 percent of respondents reporting some change. This percent reporting a change is also high relative to historical norms. The lesson: a score near the no-net change mark does not necessarily mean the market is stable.”

In the macroeconomy, employment showed a continuation of previously cited trends: the U.S. unemployment rate continued to decline, while initial jobless claims remained stubbornly high. While the improving unemployment rate is encouraging, many signs point to slowing momentum. Factors such as economic stimulus, the U.S. election, and the pandemic make ironclad prediction impossible, but don’t be surprised if the unemployment rate stalls out or even climbs again before the end of the year.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.

Follow Business Trends with AVIXA

- An Ounce of Growth for Pro AV (Nov 2020 SCN)

- Pro AV Recovery Makes Feeble First Steps (Oct 2020 SCN)

- This Is Refreshing: Good News for Pro AV (Sep 2020 SCN)

- Pro AV Industry Achieves Neutral Growth Conditions (Aug 2020 SCN)

- Trends Start to Bend Upward (July 2020 SCN)

- Pro AV Suffers Under Weight of COVID-19 Crisis (June 2020 SCN)

- Pro AV Feels COVID-19 Impact (May 2020 SCN)

- Coronavirus Shoe Yet to Drop for Pro AV (Apr 2020 SCN)

- Pro AV Sales Growth Slows at the Start of 2020 (Mar 2020 SCN)

- Pro AV Grows as New Decade Dawns and Brexit Looms (Feb 2020 SCN)