2025's AV/IT Industry Mergers, Acquisitions, and Other Significant Announcements

No fewer than 30 M&A and other announcements were made, including a merger, an acquisition, and a rebranding by three companies on the recently released SCN Top 50.

2025 was a busy year with no fewer than 30 significant announcements. As I write this, the year has not come to an end, and I wouldn't be surprised if an update is needed in the next couple of weeks, so stay tuned.

Last week, the 2025 SCN Top 50 Systems Integrator list was released. It's no surprise that a merger, an acquisition, and a rebranding were announced by companies at the top of the list.

In August, 26North Partners LP announced the completion of the acquisition of a controlling stake in AVI-SPL from Marlin Equity Partners and other selling shareholders. In my interview with AVI-SPL's CEO, John Zettel, he said, "We have had three previous financial equity sponsors in private equity, and they all have been unique and brought certain relationships and benefits to our company over the years. In 26North, after a wide and long vetting process, we really narrowed in on 26North for a couple of reasons. Their understanding of the industry, their extreme desire for the industry, and what is going to benefit AVI-SPL. Because ultimately, we'll be able to continue to do what we're doing."

But that wasn't the only acquisition news from AVI-SPL. Not long after the 26North deal was signed, the company announced the acquisition of CCS Presentation Systems Southwest. In a recent interview with SCN content director, Mark J. Pescatore, Zettel said, "Acquisitions are an important part of our growth strategy. They help us reach new markets and go deeper in the ones we're already in. But the truth is, less than a third of AVI-SPL's growth comes from acquisitions. Most of it is organic, driven by the great work our teams are doing and the deep relationships we have with our customers." AVI-SPL continues to hold the top spot on the SCN Top 50—by a large margin.

If you weren't paying attention to the news, it might appear that a newcomer snuck in at number three on the Top 50, but it's our friends from what is formerly known as AVI Systems. In April, AVI Systems ushered in a new era by announcing a rebrand to FORTÉ. "We have become much more than an AV systems integrator," Jeff Stoebner, CEO, FORTÉ, told SCN.

Coming in at number six on the Top 50 is Yorktel-Kinly. In August, Yorktel, along with portfolio company One Equity Partners, signed an agreement to combine with Kinly, creating a workplace experience and collaboration provider with expanded reach.

From small to large, a plethora of other companies round out the year with news of expansion through mergers and acquisitions, rebranding, and divestitures.

A daily selection of features, industry news, and analysis for AV/IT professionals. Sign up below.

As always, we are grateful to be chosen to break the news on certain stories to our readers.

The list below represents the most recent announcement at the top.

TRISON Acquires Pioneer Group

TRISON, a global company dedicated to the digital transformation of physical spaces, acquired Pioneer Group on Dec. 1. Pioneer Group focuses on being a multi-service provider of audiovisual solutions, network infrastructure, and electrical services mainly in the quick service restaurants and stadia verticals, as well as retailers and corporate clients. This acquisition expands TRISON's offerings by leveraging the expertise that Pioneer Group has gained over its 14 years in business. Pioneer Group has a strong client base that includes well-known names such as KFC, Joe and The Juice, and numerous sports clubs.

Broadsign Acquires Place Exchange

Out-of-home (OOH) ad-tech provider Broadsign has acquired Place Exchange, an independent OOH supply-side platform (SSP), with a minority investment from Crestline Investors. Combining Broadsign’s content management system, ad serving, and buy-and-sell side capabilities with Place Exchange’s SSP and complementary solutions, the acquisition bolsters Broadsign’s global programmatic digital OOH offering and fast-tracks innovation across its entire OOH ad-tech portfolio. Broadsign publishers will be able to tap into new demand sources while Place Exchange’s DSP partners and media buyers gain access to premium international inventory on the Broadsign Platform.

“Demand for OOH advertising continues to hold strong, but for the OOH market to seize new growth opportunities, rapid evolution is key," shared Burr Smith, CEO, Broadsign. "The acquisition of Place Exchange will allow Broadsign to deliver the most comprehensive OOH advertising solution in the market. We see the future of OOH as smarter, more efficient, dynamic, and measurable. With Place Exchange’s team and technology, and Crestline’s investment, Broadsign will deliver on that vision much faster.”

Acquisition Alert: VITEC Acquires Datapath

VITEC formally announced the acquisition of Datapath, a strategic move designed to strengthen VITEC’s video wall and video distribution portfolio, offering customers access to expanded engineering capability, customer support, distribution, and geographical reach. Datapath is known for its real-time video processing for large-scale video walls, AVoIP content distribution, and KVM control in mission-critical control rooms, commercial applications, and creative environments.

The integration will see Datapath’s product names and categories—including its video wall controllers and processors, AVoIP solutions, capture cards, and control room solutions—preserved within the VITEC portfolio. VITEC intends to maintain familiarity while enhancing support and development capabilities for Datapath. Datapath serves customers in more than 100 countries across multiple verticals.

Sound Productions Acquires ProAudio.com

Sound Productions (SoundPro) has acquired ProAudio.com, based in Grand Prairie, TX. Founded in 1971 as Crouse-Kimzey Company, ProAudio.com has been a resource in the Pro AV with deep roots in broadcast, installation, and live sound markets. ProAudio.com will begin integrating its operations under the Sound Productions brand. During the transition, customers can continue to expect the same great service, with expanded access to SoundPro’s extensive inventory, educational resources, and technical expertise.

“We’re thrilled to welcome the talented ProAudio.com team to the SoundPro family,” said Joshua Curlett, CEO of Sound Productions. “Our companies share a long history in this industry and a deep respect for the professionals who power it. With this acquisition, SoundPro is expanding what we can offer customers across every market we serve, nationally.”

Biamp, ClearOne Execs Offer Further Clarity on Acquisition

Biamp announced it was acquiring assets from ClearOne. Those assets include several patents, plus intellectual property and brands related to audio processing, microphone array processing, echo cancellation, and beamforming designs and techniques. According to Rashid Skaf, Biamp president, CEO, and co-chairman, the move strengthens the company's "deep audio engineering foundation and will enhance future product innovations across our portfolio."

Joe Andrulis, EVP of corporate development for Biamp, provided SCN with more details about the acquisition. First, he clarified that the transaction was an asset purchase through which Biamp acquired only select designs, patents, and related technologies from ClearOne.

Pixel Power Acquired by Imagine Communications

Imagine Communications will acquire Pixel Power Limited, a wholly owned subsidiary of Rohde & Schwarz, representing a strategic alignment for both companies. The move enables Imagine to offer broadcast customers an extensive portfolio of live production and playout solutions, while allowing Rohde and Schwarz to focus on its core operations in test and measurement, technology systems, and networks and cybersecurity. The acquisition is expected to close in 2025 and is subject to customary closing conditions.

Suirui International Required to Divest 2020 Acquisition of Jupiter Systems

On July 8, 2025, President Donald Trump issued a presidential order, retroactively prohibiting the February 2020 acquisition of Jupiter Systems by Hong Kong-based Suirui International and its larger Suirui Group. The company was given 120 days to divest its stake in Jupiter Systems' assets and property.

TAA-compliant video wall processors from Jupiter Systems power mission-critical control rooms across U.S. agencies, making it a high-stakes player in the national security conversation. According to Craig Stumbaugh, VP of global sales for Jupiter Systems, Suirui has been referred to as the "Zoom of China" because of its dominance in Asian markets—but its reach ends there.

The investigation of the acquisition began in late 2024 when questions around whether the proper documentation was submitted to the Committee on Foreign Investment in the United States (CFIUS). While the investigation has not uncovered any security breaches, the review by CFIUS signals Washington's willingness to retroactively block a deal viewed as strategically risky.

Ross Video Acquires ioversal

Ross Video has acquired ioversal, creators of Vertex, an immersive experiences platform. The acquisition marks Ross Video’s expansion into experiential technologies, strengthening its end-to-end live production ecosystem.

The Vertex AV production suite is designed for interactive exhibits, live entertainment, large-scale productions, and dynamic projection mapping. Vertex provides the tools to unify video, audio, lighting, and control into one solution to create, manage, and automate captivating experiences.

Avidex Acquires CCS New England

Avidex announced the acquisition of CCS New England, one of the region’s premier systems integrators serving the greater New England region. The acquisition is part of Avidex’s strategic growth plan, aimed at expanding its reach in key U.S. markets to better serve enterprise, healthcare, education, and government clients.

“The acquisition of CCS New England represents a pivotal moment in our mission to transform how organizations collaborate, connect, and communicate while also supporting our strategy to expand Avidex’s impact in key regions across the United States,” said Jeff Davis, CEO, Avidex.

HARMAN Acquires Sound United. Here's What to Know

HARMAN International has completed the acquisition of Sound United. Sound United’s portfolio of audio brands includes Bowers & Wilkins, Denon, Marantz, Definitive Technology, Polk Audio, HEOS, Classé, and Boston Acoustics. HARMAN is now empowered to bring consumers more choice, deeper innovation, and exceptional experiences across listening environments.

This strategic milestone marks a significant expansion in HARMAN's core audio business and footprint across key product categories including home audio, electronics (amplifiers, hi-fi components, AVRs), headphones, and car audio. Combining Sound United’s distinguished portfolio with its audio business enables HARMAN to deliver a more comprehensive audio portfolio.

AVI-SPL Acquires CCS Presentation Systems Southwest

The acquisition of CCS Presentation Systems Southwest strengthens AVI-SPL’s resources in the U.S. Southwest region. This region has shown considerable growing demand for IT services covering the full lifecycle of unified communications, audiovisual, collaboration, and experience technology solutions.

AVI-SPL Acquisition Completed

On August 13, 2025, 26North Partners LP announced the completion of the acquisition of a controlling stake in AVI-SPL from Marlin Equity Partners and other selling shareholders. Marlin and select shareholders will retain a minority interest in the company. Financial terms were not disclosed. The agreement was announced in June.

Just hours after the announcement of AVI-SPL's acquisition by private equity firm 26North, AV Technology content director Cindy Davis sat down with CEO John Zettel to ask him the questions on everybody's minds and more

Watch the exclusive interview below:

AVI-SPL is a trusted partner to the world’s most recognized brands, serving more than 86% of the Fortune 100. The company delivers mission-critical AV, collaboration solutions, and experiential technology that power the modern workplace, with installation, integration, and managed services across North America, South America, Europe, the Middle East and Africa (EMEA), and the Asia-Pacific regions.

Kinly Merges with Yorktel

In August, Yorktel, a portfolio company of One Equity Partners, signed an agreement to combine with Kinly.

This strategic merger will significantly accelerate global growth and expand next-generation systems integration capabilities with a larger talent base and portfolio of managed services and technology offerings. The transaction is subject to customary regulatory and other approvals.

“This acquisition is an intentional step forward to grow with purpose and is an example of what is still to come as we pursue our strategy and deliver advanced solutions to our global clients,” said Ken Scaturro, CEO of Yorktel. “We are committed to leading the next wave of agentic transformation—simplifying operations, reducing complexity, and empowering organizations to work smarter, all while improving the customer experience.”

Wowza Accelerates AI-First Strategy with Acquisition

Wowza, known for its video streaming infrastructure for mission-critical applications, recently acquired AVA Intellect, an AI-native startup specializing in intelligent and embedded agent technology for video platforms. The acquisition reinforces Wowza’s commitment to embedding AI across the entire video lifecycle, starting with capabilities that drive immediate value for customers. As part of the acquisition, AVA’s co-founder, Mike Vitale, has joined Wowza as head of intelligence, accelerating Wowza’s shift toward an AI-first product strategy.

“What drew me to Wowza was the chance to pair next-gen AI with a platform that already powers some of the most demanding video infrastructure in the world,” Vitale said. “We’re building on that foundation with new intelligence that’s embeddable and aligned with how developers and product teams want to work today—across industries, use cases, and environments.”

Exclusive Interview: Hall Technologies' CEO on Acquisition of Atlona Portfolio from Panduit

Shortly after the announcement of the acquisition of the Atlona portfolio from Panduit, Hall Technologies' CEO, Ken Eagle, sat down with AV Technology's Cindy Davis to discuss the details behind the acquisition, its implications for employees, the evolution of the two brands, and the company's roadmap through 2026.

Watch the exclusive interview below.

Audinate Acquires Iris. Here's What You Need to Know

Reported on June 30, Audinate entered into an agreement to acquire Iris Studio, which specializes in AI-powered, cloud-based camera control technology. Audinate and Iris are actively working on integrating future roadmaps to bring Iris functionality to Dante customers.

“The addition of Iris to the Dante ecosystem is a major step forward for the Dante platform,” commented Aidan Williams, co-founder and CEO of Audinate. “Combining Iris's broad applicability and cutting-edge remote production capabilities with powerful cloud-based management software like Dante Director will provide significant value for customers managing the millions of Dante-enabled devices in the field today.”

NETGEAR Acquires Exium

NETGEAR announced a definitive agreement to acquire Exium, a cybersecurity company, as part of its continuing investment in cloud-based solutions for advanced business connectivity. The acquisition builds on the company’s goal of delivering next-gen networking solutions that provide simplicity, reliability, and cost-effectiveness to small and medium enterprises. Exium’s products and expertise will help to add an integrated Secure Access Service Edge (SASE) platform to NETGEAR’s robust network offering. This solution will offer the first, completely integrated, network and security solution, purpose built for MSPs and SMEs.

CTI Acquires Candeo Vision of London

CTI has acquired Candeo Vision of London, U.K. The company is known for its expertise in AV integration, and its locations in London and Nottinghamshire mark CTI’s first presence in the U.K. CTI currently serves customers worldwide and across the United States as a member of the PSNI Global Alliance.

“In their nineteen years serving clients across the United Kingdom, Candeo Vision has built an excellent team and a great reputation,” said John Laughlin, CEO of CTI. “I’ve grown to admire the company through the work we’ve shared as members of the PSNI Global Alliance. They’re the right people to bring CTI into the UK, and I look forward to seeing them grow and prosper with the resources that CTI brings.”

This marks yet another acquisition since February 2024 for the audiovisual, IT, and unified communications (UCC) solutions provider. This is the third acquisition of 2025.

Sound Devices Acquires JH Audio

Sound Devices has announced the acquisition of JH Audio, a U.S.-based in-ear monitoring developer and manufacturer. The deal brings the two pro audio technology brands under the Audiotonix group portfolio, which also includes Allen & Heath, Calrec, DiGiCo, DiGiGrid, Fourier Audio, Harrison, KLANG:technologies, Slate Digital, Solid State Logic, and sonible.

“We couldn’t be more excited about bringing the JH Audio team into the Sound Devices fold," said Matt Anderson, CEO of Sound Devices. "Both teams’ R&D aspirations and the close link between RF and IEMs align perfectly, and with a focus on innovation to deliver future synergies across our Astral family and other products is one that has me, and the whole team here salivating, and one that should delight all our customers in the coming months.”

AVPro Global to Acquire RTI

AVPro Global Holdings has entered into a definitive agreement to acquire Remote Technologies Incorporated (RTI), known for its intelligent home and business control and automation solutions. With the move, AVPro is adding to a collection of companies that already includes AVPro Edge, AudioControl Pro, Bullet Train, ThenAudio, and Murideo.

RTI’s portfolio includes remote controls, automation apps, processors, touchpanels, keypads, and AV signal routing solutions. By uniting AVPro’s expertise in audio and video signal connectivity with RTI’s remote control and automation solutions, the company aims to drive accelerated innovation and deliver a seamless experience for end users.

Sonance Acquires Blaze Audio

Sonance has acquired Copenhagen, Denmark-based audio innovator Blaze Audio. This strategic acquisition secures the Blaze Audio brand and its sales and marketing operations, reinforcing Sonance’s long-term commitment to delivering complete audio solutions and enhancing its presence in the global professional audio sector.

"This is about more than just expanding our product portfolio," said Ari Supran, CEO of Sonance. "It’s about bringing together two companies that share a commitment to quality, innovation, and customer-first thinking. Blaze Audio brings a bold, focused amplifier lineup and adds sound reinforcement loudspeakers that help fill out the Sonance Professional loudspeaker range. This combination will help us push the boundaries of how integrated audio can perform and look across professional, residential, and marine applications."

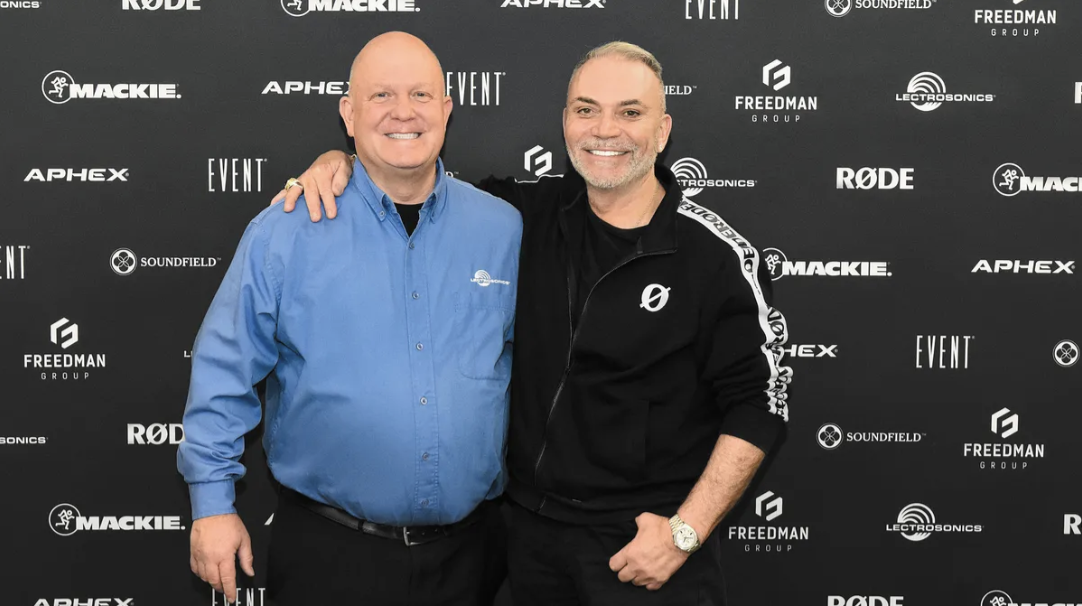

Lectrosonics Acquired by The Freedman Group

The Freedman Group, parent company of audio brands including RØDE, Mackie, Aphex, SoundField, and Event Electronics, has acquired Lectrosonics, the U.S. manufacturer of professional wireless audio systems.

Founded in 1971 and headquartered in New Mexico, Lectrosonics has been at the forefront of UHF wireless audio technology for film, broadcast, and high-end theater applications for over five decades.

CTI Acquires LightWerks

CTI has acquired LightWerks of Carson, CA. This expands CTI’s current operations in Los Angeles, Orange County, San Diego, and the San Francisco Bay Area, while bringing Boise, Idaho, and Montana into CTI’s coverage for the first time. CTI serves customers worldwide as a member of the PSNI Global Alliance and across the US, with locations from Michigan to Texas and New Jersey to California.

AVI Systems Rebrands as FORTÉ

AVI Systems is ready to usher in a new era. Announced at its annual Global Sales Summit on April 22, in Dallas, with approximately 330 staff and nearly 300 partner attendees present, the integrator announced a rebranding to the name FORTÉ.

“We have become much more than an AV systems integrator,” Jeff Stoebner, CEO, FORTÉ, told SCN. “In recent years, we made a series of major investments to grow the business's capabilities and expanded office locations to serve every major market in the U.S. We’ve also expanded our global deployment capabilities, created robust managed services offering, developed five innovative practices areas with deep industry expertise, and we’re able to deliver solutions with unmatched speed with our Velocity solutions. Due to our expanded capabilities, we’ve become a strategic partner, helping our customers transform their modern workplace."

3G Productions Purchased Assets of Switch Video

Over the past two decades, West Coast-based 3G Productions has steadily grown its live event production services and systems integration businesses. Bolstering the company’s strategic plans to diversify its client base and further develop into a national brand, 3G Productions announced last month that it purchased the assets of Switch Video, a provider of video rental services for the film/television, corporate/tradeshow, and live event and touring industries.

3G assumed ownership of Switch Video’s operations in both Castaic, CA, and Atlanta, rebranding them as 3G Productions facilities. Switch’s leadership team—including industry veterans Alan Barber, Justin Edgerly, and Shawn Orm—will remain with 3G and will be tasked with leading the business development of the company’s new vertical markets.

Powersoft Acquires 51% of K-Array

Powersoft Group today announced a binding investment agreement to acquire 51% of the share capital of K-Array from H.P. Sound Equipment. The agreement also allows for Powersoft to purchase the remaining 49% of K-Array's share capital. The transaction is expected to close by next month.

By combining its know-how in amplification systems, signal processing, and transducers with K-Array's expertise in compact, high-performance loudspeaker engineering and design, Powersoft will be able to accelerate its expansion in these markets and strengthen its position. The combination will also open up new joint business opportunities and allow for the expansion of business offerings into new market segments within the Powersoft portfolio. Plus, the combined presence of the two companies through their distribution networks will drive greater penetration in high-growth markets such as Asia and Latin America, further consolidating the Group's global positioning.

LG Acquires Majority Stake in Bear Robotics

LG Electronics has taken a significant step in advancing its robotics capabilities by securing a majority stake in Bear Robotics, a prominent Silicon Valley-based startup specializing in AI-driven autonomous service robots.

On Jan. 22, LG’s board of directors exercised a call option to acquire an additional 30% stake in Bear Robotics. This follows an initial investment of $60 million in March 2024, which secured LG a 21% stake and a call option agreement for up to an additional 30% stake. Upon completion of the call option exercise, LG will hold a controlling 51% stake in Bear Robotics, effectively incorporating it as a subsidiary.

CTI Acquires Delta AV

CTI has acquired Delta AV of Gresham, OR, which has been serving clients in and around the Portland area for almost 30 years. CTI serves customers worldwide as a member of the PSNI Global Alliance and across the United States, with locations from Michigan to Texas and New Jersey to California.

Xpect Solutions Acquires GovDefender

Systems integrator Xpect Solutions, which has been delivering IT and physical security solutions to federal agencies for more than 20 years, recently announced its acquisition of GovDefender, which is known for systems modernization as well as enterprise IT web, mobile, and application development. The strategic acquisition enhances Xpect Solutions’ ability to provide technology solutions for federal law enforcement and national security customers.

New Year's Acquisition: AVI Systems to Add AVCON

AVI Systems is starting the New Year with a new acquisition. Today, the company announced it will acquire Cary, NC-based AVCON, a systems integration firm that designs, installs, and maintains AVL technologies for companies, houses of worship, and other organizations. The acquisition will close on Jan. 15 and will include transitioning all AVCON employees to AVI Systems.

“AVCON’s founder, Frank Yarborough, has built an incredible company with a stellar reputation for audiovisual design and support,” said Jeff Stoebner, CEO of AVI Systems. “The alignment between AVI and AVCON is quite remarkable in that both organizations strive to be a trusted advisor to each customer we serve. I look forward to having Frank and his team become employee-owners at AVI Systems and help us continue our growth trajectory.”

Cindy Davis is the brand and content director of AV Technology (AVT). She was a critical member of the AVT editorial team when the title won the “Best Media Brand” laurel in the 2018 SIIA Jesse H. Neal Awards. Davis moderates several monthly AV/IT roundtables and enjoys facilitating and engaging in deeper conversations about the complex topics shaping the ever-evolving AV/IT industry. She explores the ethos of collaboration, hybrid workplaces, experiential spaces, and artificial intelligence to share with readers. Previously, she developed the TechDecisions brand of content sites for EH Publishing, named one of the “10 Great Business Media Websites” by B2B Media Business magazine. For more than 25 years, Davis has developed and delivered multiplatform content for AV/IT B2B and consumer electronics B2C publications, associations, and companies. A lifelong New Englander, Davis makes time for coastal hikes with her husband, Gary, and their Vizsla rescue, Dixie, sailing on one of Gloucester’s great schooners and sampling local IPAs. Connect with her on LinkedIn.