Back in July of 2020 with the launch of the mid-year Industry Outlook and Trends Analysis (IOTA) briefing report, AVIXA described the shape of the recovery for the pro AV industry like a Nike swoosh, in which we would see a steep initial rebound followed by a leveling off. Research went further to say that upon zooming in on any section of the swoosh, one might see bobbles as the curve trends up or down during smaller time increments. And so here we are at one of those points in time.

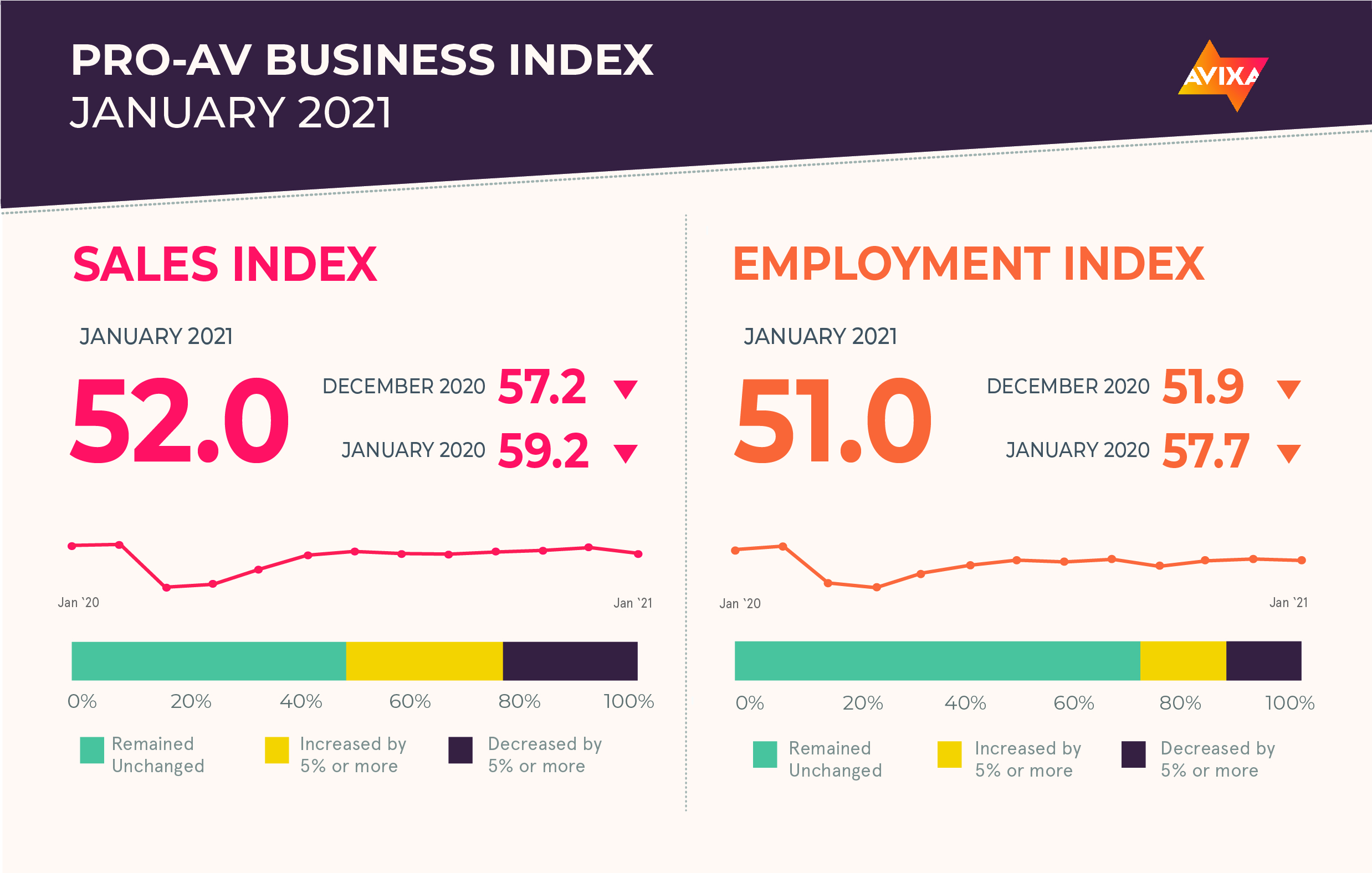

In the latest Pro AV Business Index, January’s AV Sales Index (AVI-S) shows a drop of 5 points from the prior month, to 52.0, reflecting a slower start to the year. To be clear, a 52 still indicates overall growth among the AVIXA Insights Community, which is good news after a strong close to 2020. But growth was less pervasive as we began 2021, with comments mentioning a continued wait-and-see approach in the markets.

“January’s results are a good reminder of the volatile situation we remain in as we chart a course out of the pandemic,” said Sean Wargo, senior director of market intelligence, AVIXA. “Recovery is not often a clear and consistent upward trend. Instead, it is marked by many smaller peaks and valleys as we progress ultimately forward. We are now hitting a lower point in what is still a growth story. Expect more of these low points even as we also experience higher peaks along the path. We may set records along the way as well as contrary low points, but we are confident in a slow and steady recovery for the pro AV industry this year.”

Despite lingering challenges as the world struggles to emerge from the latest COVID waves and improve vaccine availability, survey responses indicate widespread optimism for the year ahead. The majority of providers surveyed (55.5 percent) say they expect 2021 revenues to increase significantly over 2020. This reflects a complete reversal of the trend shown last year in which a similar percentage reported a significant drop in revenues. Converting this new outlook into a diffusion index as we did with the December year-end outcomes generates a value of 66.8. Though not fully comparable to a monthly index value given the longer time range involved with this result, this would be an all-time high score. After a year of nearly ubiquitous declines across the industry, a corresponding year of growth is both expected and welcome.

Unlike the AVI-S, the AV Employment Index (AVI-E) held fairly steady for the month, indicating a slow but measured return of some of the AV-related workforce. The January reading came in at 51.0, which is down slightly from 51.9 the month prior. Slow and steady results here are consistent with overall U.S. employment numbers, which showed a modest increase of 49,000 jobs in January. Overall unemployment continues to tick downward at a similarly slow rate, dropping to 10.1 million. This marks a deep and lasting trough to recover from and will take some time as with previous recessionary periods. We expect pro AV to modestly improve in its employment-related metrics as well, once a meaningful and sustained return of projects ensues. In the meantime, reskilling remains the primary narrative within many AV workforces.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. The report comprises two diffusion indexes: the AV Sales Index (AVI-S) and the AV Employment Index (AVI-E). In each case, an index above 50 indicates an increase in sales or employment activity.

Visit avixa.org/AVindex to access the free monthly Pro AV Business Index reports and learn more about the methodology. For more information about joining the AVIXA Insights Community, visit avixa.org/AVIP.