Back in early spring, when news was released that Samsung’s LCD biz had been realigned, we are awash in pundits’ and mass media pronouncements that LCD was on the way out. OLED was the new acronym de jour. We’d all be watching OLED TVs soon, and the mall the train station would sport OLED displays in all their 10,000,000:1 contrast ratio glory. Maybe it was the word “organic” in the name. It does sound cool, and vaguely politically correct: “organic light-emitting diode (OLED) panels”.

OLED is beautiful. Stunning image. But I was an early skeptic, and said then, as I say now: the LCD panel has never been stronger in the market. It will continue to dominate the TV market. Any move to OLED or other platforms is years away– well beyond any need for a reevaluation of the market. And digital signage– there is no serious rival for traditional, low-cost display.

But since then, there has been more OLED fever. You've all read it.

But finally, even the mass media is realizing the hype was over-done. Just last week, Miyoung Kim of Reuters wrote (December 10th):

"Liquid-crystal display (LCD) screens were expected to slowly fade and die, giving way to lighter, thinner and tougher organic light-emitting diode (OLED) panels in everything from smartphones to televisions.... But LCD is refusing to go quietly as its picture quality keeps getting better. At the same time, the major backers of credit card-thin OLED panels - led by Samsung Electronics Co and LG Electronics Inc - are struggling to make the technology cheap enough to mass produce ..."

Now, today, back to the trade press, with more sensible analysis, this time from our friends at DisplaySearch:

Korean Panel Makers Change TV Priorities: OLED vs. 4Kx2K

Korean TV panel makers are in the process of adjusting their priorities. The adjustment is mainly due to difficulties in commercializing AMOLED TV, but also to the fact that the outlook for 4Kx2K (ultra-high definition) TV is becoming more promising.

Since the beginning of 2012, when both Samsung and LG Display demonstrated 55” AMOLED TV at CES, both have been claiming they will mass-produce large size AMOLED TVs panel within the year. However the commercialization plan has been delayed repeatedly. At the same time, aggressive pricing of some large size LCD TV on Black Friday and the resulting sales shows that, for many end users, a larger and cheaper LCD TV is more attractive than a high-end, slim, and fancy OLED TV. The emphasis on AMOLED TV has been reduced, and the new focus is on the high definition.

A fundamental challenge for AMOLED TV remains manufacturing yield. Pilot production indicates that 55” AMOLED TV panel straight yield (without repair) is in single digits due to instability in the large backplanes (using LTPS or oxide TFT). Total yield (after repair) is estimated to be less than 30%. Finally, frit encapsulation is too fragile for large area TV, and is resulting in reduced panel life.

Because of the high manufacturing costs, 55” AMOLED TV set prices are expected to be in the $10K range, a very high price compared to comparable LCD TVs. Also, due to the lifespan and reliability issues, after service costs are not predictable. There may be a need for a large advertising and education campaign to highlight AMOLED’s advantages compared to LCD TV.

After IFA 2012, Korean panel makers lost some confidence in AMOLED, and began to feel that they could not justify a further investment into capacity expansion for AMOLED. At the same time, the visual quality of 4Kx2K became clearer to consumers. For panel makers, 4Kx2K LCD TV seems to be easier to manufacture than 4Kx2K AMOLED TV.

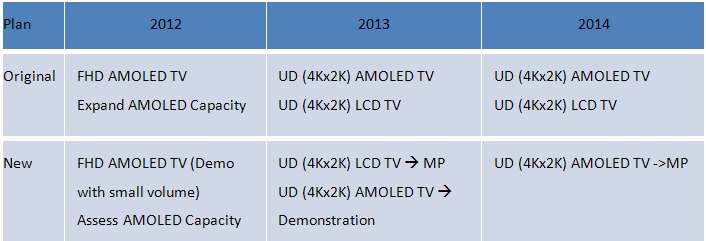

The ways in which Korean panel makers are adjusting their AMOLED and 4Kx2K TV panel development priority are shown below.