Post-InfoComm– where the focus was of course on commercial AV– it’s a useful exercise to look this week at the latest numbers from the “TV” display world. Because no matter how you parse the markets, we are all still living in a world where consumer market technology advances drive many segments of the pro AV side. Case in point: flat panels.

I still get irritated when a flat panel maker calls their LCD flat panel an “LED TV” or “LED panel”. (For me it's a cringe factor equal to hearing someone call a big LED wall at a stadium or arena a “Jumbotron”). Of course, they are talking about an LCD panel that uses LED phosphors as its light source. In other words, an LED-backlit LCD panel or TV, as opposed to the CCFL back-lit variety. And I heard plenty about “LED” at InfoComm that was, you guessed it, LCD panels.

Taxonomy aside, the story here is bigger LCD panels, and cheaper by the inch. We saw some of these same big-footprint panels, in slightly different iterations, at InfoComm last week. No matter how you spell it, LCD panels continue their upward climb– despite fluctuations in quarter to quarter numbers. Here is the latest report from DisplaySearch. Ignore the headline and look at what we journalists call the “deck” i.e. the subheadline: that large sizes are “experiencing strong growth”. And, as a bonus, they don't call LCD panels “LED”, they use the proper term “LCD-backlit LCD”:

Global LCD TV Shipments Fall for the First Time Ever in Q1’12

LCD TV Unit Shipments Fall 3% Y/Y in Q1’12, All Other Technologies Down as Well; Large Sizes Experiencing Strong Growth as Affordability Improves

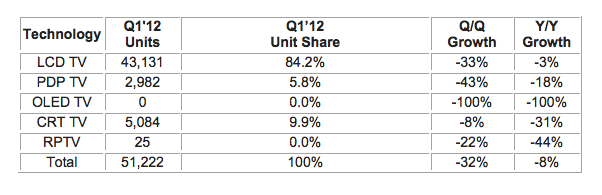

Santa Clara, Calif., June 20, 2012—Worldwide TV shipments fell almost 8% Y/Y in Q1’12, the steepest rate of decline since Q2’09. Total TV shipments for the quarter were 51M units, according to the latest release of the NPD DisplaySearch Advanced Quarterly Global TV Shipment and Forecast Report. The biggest contributor to this decline was a slowdown in shipments of LCD TVs, which fell year-on-year for the first time in the history of the category, declining just over 3%, to 43M units.

“Soft demand and cautious expectations about the upcoming year in many parts of the TV supply chain have led to a slowdown in shipments,” noted Paul Gagnon, NPD DisplaySearch Director of North America TV Research. Gagnon added, “Key component prices, such as LCD panels, are not expected to decline much in 2012, and many brands are concentrating on improving their bottom line. Both of these trends will contribute to slowing unit volume among a price conscious consumer market.”

LCD TV shipment share fell slightly from Q4’11, due to a seasonal shift to emerging markets where CRT demand is higher, but is up four percentage points from a year ago, to 84.2%. LCD TV is capturing market share at 40” and larger screen sizes because of a sharp decline in plasma TV demand. The average LCD TV screen size increased 5% Y/Y in Q1’12, passing 35” for the first time, with gains in both emerging and developed markets. The share of LCD TVs with LED backlights also rose sharply, from 51% in Q4’11 to almost 56% in Q1’12, 20 percentage points higher than a year ago because more affordable direct-type LED-backlit sets began shipping in Q1’12.

Plasma TV unit shipments continued to decline, falling 18% Y/Y in Q1’12 after an 8% decline in Q4’11. The popularity of plasma TV among consumers is waning, and a large majority of the recent shipment volume remains centered on low-priced 2D HD models, indicating consumers are buying on price when shopping for plasma.

Despite the weak results on a unit basis, demand for larger sizes continues to grow. The market share for 40” and larger TVs increased from just under 31% a year ago to more than 37% in Q1’12 with total unit shipments for 40”+ rising 12% Y/Y. Larger sizes have become much more affordable with 40-44” LCD TV average prices below $600 and new 50” LCD TVs selling for less than $1000, joining 50”-class plasma TVs that have been selling for less than $700 for several quarters now.

Source: NPD DisplaySearch Advanced Quarterly Global TV Shipment and Forecast Report

China remains the #1 region for TV shipments at 20% of all units shipped during the quarter, down very slightly from the previous quarter. However, growth slowed significantly during the seasonally important Q1 leading to Golden Week holidays, with unit shipments falling 4% Y/Y after growing by double digits the previous three quarters. Flat panel TVs are starting to saturate China’s higher-income urban markets, but prices are still too high to kick off a wave of upgrades in rural markets. Asia Pacific (which includes India, Korea, and Australia) was the #2 region for TV shipments, followed by North America and Western Europe.

3D Shipment Share Increases Slightly to Just Over 14% of Global TV Shipments in Q1’12

3D shipment share continues to grow, albeit more slowly in recent quarters, rising to just over 14% of total TV shipments and 16% of flat panel TV shipments. Demand for 3D in emerging regions is actually higher than in developed regions, with 16% of flat panel TV units shipped to emerging markets in Q1’12 compared to 15% among developed regions.

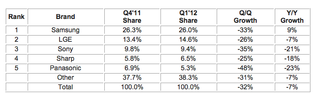

Samsung Remains the #1 Flat Panel TV Brand

Samsung’s global flat panel TV revenue share remained around 26%, near record levels and was the only one of the top five flat panel TV brands on a revenue basis to show Y/Y growth during Q1’12. Samsung also was the top brand in the key segments of LCD TV, 40”+, LED-backlit LCD, and 3D TV.

LGE was the #2 brand and showed a significant improvement in market share, rising more than a percentage point to 14.6% revenue share. Sony rounded out the top flat panel TVs on a revenue basis, but posted a large drop in Y/Y revenues along with fellow Japanese brand Panasonic.

Table 2: Q1‘12 Worldwide Flat Panel TV Brand Rankings by Revenue Share

Source: NPD DisplaySearch Advanced Quarterly Global TV Shipment and Forecast ReportFor more information: www.displaysearch.com