My longtime audio engineer friend uses a saying "Everybody knows two jobs, theirs and audio." Of course he is referring to the fact that audience members think nothing of walking up to the front of house position and telling the engineer there's too much low end or worse, we can't hear in the back. However, I can't recall an attendee walking up to the video engineer and saying there's too much magenta in the blacks or telling the lighting designer that there's a dark spot in the stage wash. This same engineer would also tell me that the best shows are the ones where the audio didn't interfere with the content. People will always remember bad audio, but they barely notice good audio. If you use what the customer remembers from the last audio project, you have a better chance of winning their next one.

Having managed sales people for a number of years I can also tell you that audio is the one thing they think they know how to sell. And on some levels audio for events is fairly simple to budget, but selling audio for corporate events is something most of us do very poorly. Try using this three-step process and see if you don't close more jobs. Start by understanding what kind of customer you are dealing with, next explain what working with your company will be like, and then show them a sample of what you will do.

Know Your Audience

Every customer cares about audio, but not all in the same way. To size up your customer, ask what they liked about their last audio supplier. If the first thing they mention is the audio engineer, then your focus should be on how easy your engineers are to work with. Explain that your company lets the audio team put the right products on the show. Offer to have the engineer join the customer in a pre-meeting phone conference to talk about the important elements of the event. Emphasize how well your company supports the technicians in the field - customers like to know that their show site buddies are being taken care of.

If the customer wants to talk about all the problems that occurred on their last show, then stress how your company will gather the right engineers and package the right equipment to avoid those challenges on this project. Now might be the right time to explain why audio design is so important and that room drawings and system design should be standard for a project as sophisticated as theirs.

If cost is the first thing that comes up -- don't run away! This customer needs to know that your company will work with them to get the most value on their audio system. This is a great opportunity to collaborate on room layouts and schedules. Demonstrate how over-packing the room adds to the sound budget. Get that rehearsal time moved back an hour so the load-in can start on straight time. Ask more about the last show: If everything had gone perfectly, would the price have been all right? Perhaps it seemed too expensive because things were done poorly.

Sell the End Result

Regardless of which kind of customer you have, the next step is to prepare a scope of work. This means defining and describing what the package will and won't do. It also defines what your company is responsible for and what the customer will take care of. Depending on the customer, you might want to talk about the gear -- but scope is really about the end result more than the plan.

Scopes do not have to be complicated and are often in the customer's own words (without being too obvious). Show them that you understand the requirements of the audio system and have accounted for the known challenges of the particular application. If the proposal is for a generic project, then the scope has to be clear as to what your assumptions are. For instance, if you and the customer can agree that the project will have an audience of one thousand people sitting theater style, then your scope would state this and note that changes in the audience configuration may affect the budget.

Paint a Picture

The final step is to explain HOW you will get the job done. Most companies resort to a detailed equipment list at this point, but I recommend never doing that until you have a confirmed project (and then only if the customer needs to see it). If you are dealing with an uneducated user, I recommend including photos of the kinds of gear you will be using. If it is flown speaker clusters -- they need to know what that looks like. If there's a big front of house package, they need to be prepared to give you enough space. Pro customers want to see manufacturer names and model numbers, but unless you have collaborated with them on a system design, refrain from sharing the complete details of your solution. Don't give them a shopping list!

Price shoppers (or Value Customers as we like to say) won't pay for a lot of value-added services. That includes your proposal. Give these folks a down and dirty scope of work and a price. Your scope may need to include product names in order to fulfill the specification (for instance, if they specifically asked for an XYZ system), but never give quantities unless the customer provided you with a detailed list of the equipment they require. In those cases, bid only what they ask for and provide a scope of work with a disclaimer that says you are not responsible for the suitability of this equipment for the application. In short, win the job on price and work on adding value (and profit) later.

MARKET SNAPSHOT

Who Has Time for Marketing and Planning?

By Tom Stimson, CTS

It’s been a roller coaster year of economic news. Oil prices have been all over the map, the dollar started out in the dumps and now its regaining ground on the Euro, and now no one is sure whether the US economy is weak or strong. One thing is for sure; everyone is pretty tired of talking about it. Seems like a good month to ask about marketing and general business practices. This month’s survey touches on several things related to daily office life such as “Who answers the phone?”

"How often do sales folks visit job sites?” and “Who reviews proposals?” But there are also a series of questions related to customer-facing activities and internal meetings. Here’s a sample of this month’s results:

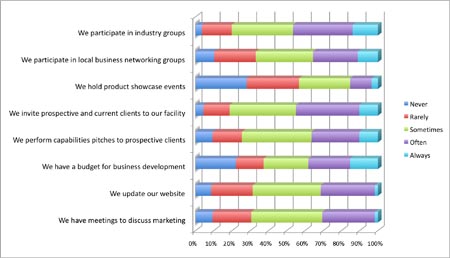

Chart 1

In Chart 1 we see the results of how often the eight statements match the respondents’ company behavior. In general what you see is that one third of respondents say they do the activity sometimes. And about one-third does that thing rarely or never. So a company looking to do something new or different could choose any one of these activities regularly and be different from MOST everyone else most of the time. Incredible?

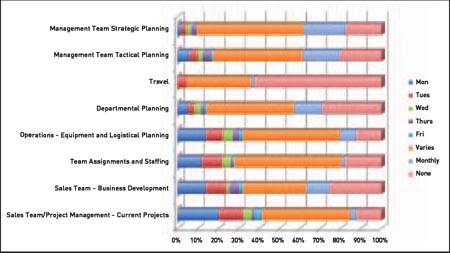

Now, take a look at Chart 2. Here we ask what day of the week the respondents’ company holds meetings on these topics. The pinkish color on the far right indicates there are no (none) meetings held by a surprisingly large number of folks on some pretty important issues. The very large number of answers that indicate no regular schedule for these meetings (varies) suggests that these events are ad hoc or worse, reactions to surprises. And barely one-third has weekly meetings to discuss ongoing projects!

Chart 2

It’s hard to draw a lot of conclusions from these two charts other than there is a lot of room for improvement. There is clearly more to be done when it comes to reaching out toward customers. How can you measure the return on marketing costs if you don’t do any? And, how can we hold our processes accountable when we don’t ever meet to discuss them? No one wants to have more meetings, but maybe if we had better meetings we’d get better results. Sounds like good topics for future columns.

Download the complete August ‘08 Survey including dozens more illuminating comments from respondents at: www.trstimson.com/surveys.

Each month The Stimson Group conducts a short survey of AV industry professionals about a variety of topics. To participate in or comment on those surveys, email: surveys@trstimson.com.