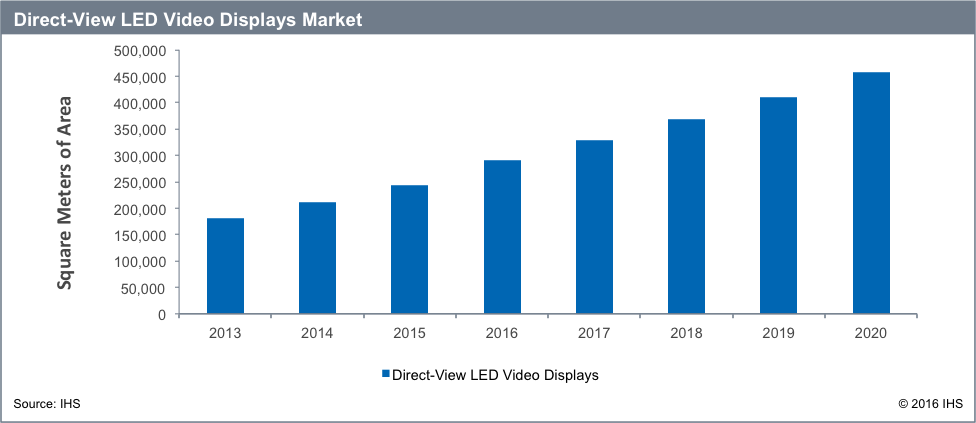

- Total unit shipments for all pixel-pitch categories in the direct-view light-emitting diode (LED) video market recorded a 15.6 percent year over year increase in 2015.

The projected growth of LED video displays

Total revenue for 2015 only improved by 1.2 percent in 2015 compared to the previous year, due to a dramatic price decline across all pixel-pitch categories. Unit shipments in the direct-view LED video category are forecast to increase steadily at a compound annual growth rate of 16 percent from 2016 through 2020, according to IHS Inc.

“Application trends for the LED video industry differ slightly from other technologies, with little or no installations in corporate and education signage, which tend to rely instead on front projectors and LCD displays,” said Sanju Khatri, director of digital signage and professional displays for IHS Technology. “The top applications for LED video are retail, outdoor sports and public spaces. There is a growing trend in indoor applications, particularly in public spaces, retail, control room and corporate signage.”

The direct-view LED video market ended 2015 with a 366 percent increase year over year for sub-1.99 millimeter and a 129 percent increase year over year in 2 mm to 4.99 mm pixel pitch LED video displays, the two fastest growing categories of display resolution. Most of the growth in these resolutions can be attributed to recent technological developments in fine pixel-pitch direct-view LED displays, according to the latest IHS Digital Signage and Professional Displays Market Tracker.

Albeit slower than 2015, robust growth in these two categories is expected to continue in 2016, with an 84.8 percent rise in shipments expected for sub-1.99 mm and 77.1 percent for 2 mm to 4.99 mm pixel-pitch LED video displays.

IHS expects the rate of advancement towards finer pixel pitch to slow significantly in the short term, due to the size limitations of current LED packaging. At the moment the narrowest pixel-pitch LED video display is Leyard’s 0.7 mm product, launched in September 2015. The price difference between sub-1 mm and 1.2 mm-to-1.9 mm pixel-pitch displays is almost two times greater; hence, 1 mm pixel pitch LED video displays are rarely installed in a video wall configuration. Unilumin, Aoto, Leyard and other major brands are positioning sub-1 mm pixel-pitch LED video displays as a large format display for retail stores, control rooms, conference rooms, airports and other indoor applications.

In the longer-term, the industry is migrating to a new type of packaging called chip on board (COB) in lieu of the traditional surface mount device, specifically for fine pixel-pitch LED video displays.

“The use of COB allows for a much higher packing density of LEDs, enabling compact arrays of LEDs that are more heat efficient, cost effective, longer lasting and reliable,” said Khatri. “The LED video display market can look forward to this transition as the production of COB LEDs ramps up.”